I think Ethereum is the most important infrastructure in the world: both for what it is and what it can be.

And it will never be enough. There must be other layer 1s. I believe natural law demands it. If not, DeFi will break one day. Because blockchains are organisms

Making Ethereum the “mother of all chains” L1 makes DeFi fragile. I think there is plenty of precedence for this. We should want 5-6 other L1s that are ~80% ETH's size.

WHEN YOUR SIZE IS TOO MUCH SIZE

A paleontologist named Edward Cope who observed that species tend to increase in size over time. He called it Cope’s Rule, but it’s more a principle, since it’s not universally true. It has important implications for evolutionary patterns.

The evolutionary motivation for Cope’s Rule isn’t straightforward. Some hypothesis are larger size confers advantages in terms of survival and reproduction: think increased strength, better thermoregulation, access to more food resources, being higher up on the food chain, etc..

But not all species get larger. A logical question then is why isn’t everything the size of Godzilla? If bigger is better from a Darwinian standpoint, why are there manlets?

Nature abhors a vacuum, and a disequilibrium. There is always too much of a good thing, and there are upward limits to the benefits of size.

Nature agrees with Nassim Taleb and the Bible on this one: there is a Laffer Curve for size, and beyond a certain threshold you move from increasing robustness and capabilities, to enhancing fragility. Once something gets too large, it becomes fragile, and nature kills it.

With more bulk, you need more resources you need to exist. This nourishment requirement narrows where you can live based on natural resources and food availability.

You move more slowly with all that heft, which again narrows your dietary options. Being at the top of the food chain only means you have no predators above you, not that the animals beneath you willingly let themselves be eaten. You still have to be mobile enough to hunt.

Size takes a toll on some forms of ruggedness and withstanding trauma. The heavier an animal, the easier it dies from a fall. You can drop an ant over 15,000x its height (~1,250 feet) and it won’t die. Squirrels 150x their height. Humans die around 10x our height. If you drop an elephant just 1x its height (~10 feet) it dies.

The bigger you are, the harder it is to reproduce; gestation times take longer. Ant eggs hatch within a couple weeks of being laid. Humans take 9 months. Rhinos 17 months. Elephants take nearly 2 years. Reproduction time is a key component of survival, including your ability to withstand black swan events that wipe out large parts of the population. You must be able to quickly respawn.

However none of us are ever at the top of the food chain; Mother Nature always holds that distinction. And the bigger you become, the more susceptible you are to her scorn. You grow less adaptable, because you become slower, fragile, and restricted. This is a recipe for eventual wipeout.

Credit to Morgan Housel for introducing me to Cope’s Rule and some of the examples here. He’s a great frameworks thinker.

THE COMPANY ORGANISM

Biological laws are not reserved solely for things with a heartbeat. They’re germane to any organism. An organism defined as a coordinated system that functions as a single life form. Often living, but it doesn't have to be

These natural laws apply to organisms just like they do species. And companies can suffer similar fates as the falling elephant when they become too massive to manage. Or at best, they become sclerotic, glacial relics that decay under their own weight.

A company isn't just a legal construct that makes a product, it’s an organism.

Ethereum isn't just a blockchain that lets you swap tokens, it’s an organism. All blockchains are organisms: a multifaceted, layered, and complex one at that.

The Tower of Babel is a biblical story that is scientifically false but Darwinianly true: when you build a structure so large and complex that it tries to reach the heavens, it breaks. Taleb has made an entire career basically illustrating this biblical allegory in modern terms with practical evidence.

THE GFC: WHEN AN ELEPHANT TUMBLES

The Great Financial Crisis (GFC) exposed many financial institutions that had grown too large and complex for continued survival. Banks had become oversized elephants that took 4 years to have a baby (parallel: bureaucratic inefficiency). They had to create byzantine exotic financial products to grow profits (parallel: becoming so large food sources are limited).

The “Bob Rubin Trade”

I've written about the Bob Rubin trade before under my government-issued name on political publications. Taleb cites it often as well. It's a tale from the GFC that illustrates the moral hazard and dysfunctional destruction a corporation can experience when leadership loses control. When a structure is too complex and disparate to be competently managed.

Former Treasury secretary Bob Rubin received over $100M from Citibank in the decade leading up to its failure. Bob and other Citi executives were responsible for the complete mismanagement of the pulsating mass that was Citigroup. Resulting in $25 billion losses, a ~90% decline in share price, and $45 billion bailout from the government… over about 90 days.

How did Citi manage to lose so much? A lot of exotic debt products. A major one being “liquidity puts”, which allowed investors to sell bonds back to Citi at face value should they become illiquid. When things got illiquid, Citi was eviscerated.

How does this occur with such prestigious minds guiding the ship?

Per Rubin: "The answer is very simple, it didn't go on under my nose. At Citi, as in any large company, you have people who are specifically responsible for certain areas - trading and risk, for example - and you have senior management monitoring their work. I am not senior management. I have this side role."

Ahh yes, you get paid $100M for a “side role”! Everyone has a big prestigious position and is responsible for the success when things go well, but have merely a “side role” when it hits the fan. Many such cases!

What about the liquidity puts? Surely such a profitable product must have been something the board was aware of? Rubin says he had never heard of liquidity puts “until they started harassing Citi last summer.” Neat!

It’s called the Bob Rubin Trade because Bob got to keep every cent of that $100M he was paid, despite his decisions contributing to Citi's destruction and government intervention. Nothing clawed back. He privatized his profits, and socialized his losses. Quite the trade!

The thing is, there might be some honesty to Rubin being oblivious. Citigroup was the 14th largest company globally in 2007, had $146B in revenue across a huge array of products, operated in 160 countries, and at around 381,000 employees in 2007 had more people to manage than the entire populations of cities the size of Cleveland or New Orleans (both of which have multiple pro sports teams). Citi was enormous

Any organism Citi’s size will have actions occurring that are fundamentally unable to be managed due to its intricate complexity. If the business is high risk (eg labyrinthine financiering) you then have an elephant standing on the precipice of a 10-foot ledge to contend with.

The complexity and tail risk of the business matters in respect to the risk that accompanies its size. Example: Apple in 2023 has ~164k employees and ~$400B in revenue, but there isn’t a “liquidity put” equivalent for Macbooks and iPhones.

Apple is smaller in some ways compared to 2007 Citi, and more importantly there's no fat-tail product that if it fails will bankrupt it.

As size increases:

- Financialized, complex organisms with fat-tail scenarios have wipeout risk

- Consumer/regular businesses have decay risk

This applies to all organizations.

Warren Buffett has been candid that Berkshire will likely underperform because the capital it must deploy to move the needle is too much to beat the market anymore. Berkshire’s limited to a small investable universe of companies big enough to support the size of stake it requires. Less food to eat innit.

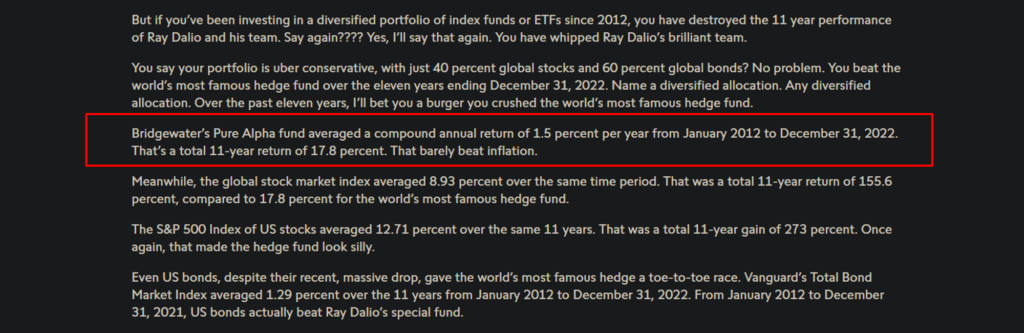

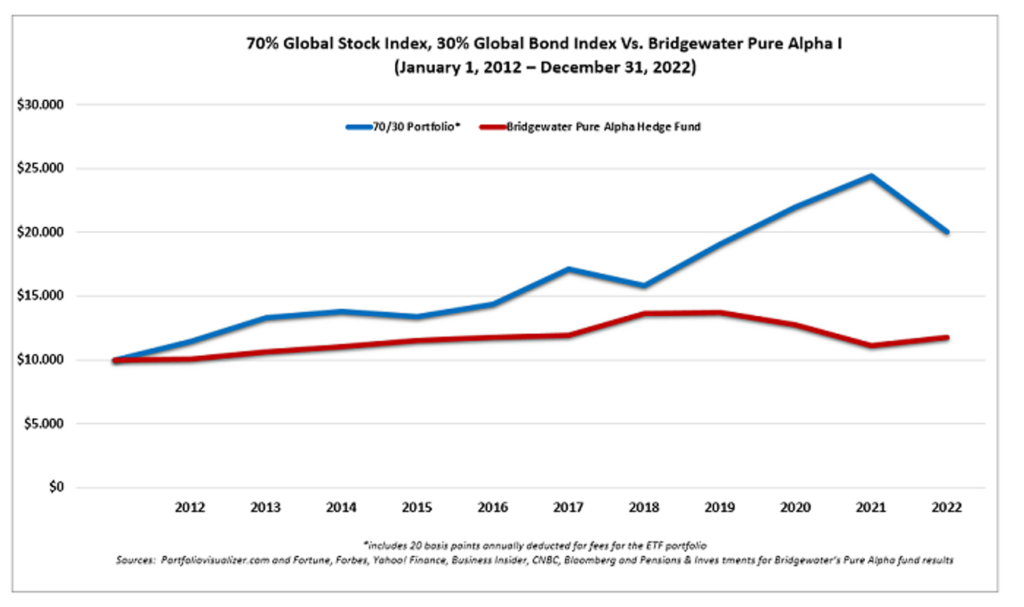

The bigger any investment vehicle gets, the more constrained it becomes. Ray Dalio’s Bridgewater is the biggest hedge fund in the world at $240B, and at that size you pretty much accept your are preordained to underperform every index.

And not just a little under performance, Bridgewater has provided investors a 1.5%/year return since Jan 2012. Pitiful. Basically the same as the inflation rate. When you’re this big, you basically can’t do anything but track global growth, at best. Size is a burden.

Unwieldy size may not kill you, but it always limits you past a certain point.

The rapid-fire progress of OpenAI and Midjourney has run circles around gargantuan Google. Is Google being left in the dust because it has less intellectual talent? Less resources?

Certainly not, in fact Google has tons more resources than its competition. And they’re focusing on AI as much as anyone. Google’s failure won’t be catastrophic like Citi’s, but rather a slow bleed to Kodak-esque irrelevance. Taken out by the agility of startups. Speed kills.

Google’s failure won’t be catastrophic like Citi’s, but it seems destined for Kodak-esque irrelevance predicated on its size and bureaucratic largesse, as it loses ground to the hypermobility and agility of startups. Speed kills.

THE BLOCKCHAIN ORGANISM

At this point, I think the takeaway for Ethereum — and any sufficiently important, complex, critical organism — should be apparent.

Ethereum is much closer to Citi complexity, layers, product, and risk than it is Berkshire or Google. The latter two examples will become stagnant, mediocre, or decline with size, and slowly fade into irrelevance as a result of lost capabilities compared to others. Citibank nearly took down the entire global financial system when the laws of biology came knocking on its door.

If Ethereum becomes what we all think it can be, it will be orders of magnitude more critical and complex than Citi. In fact it may already be getting there.

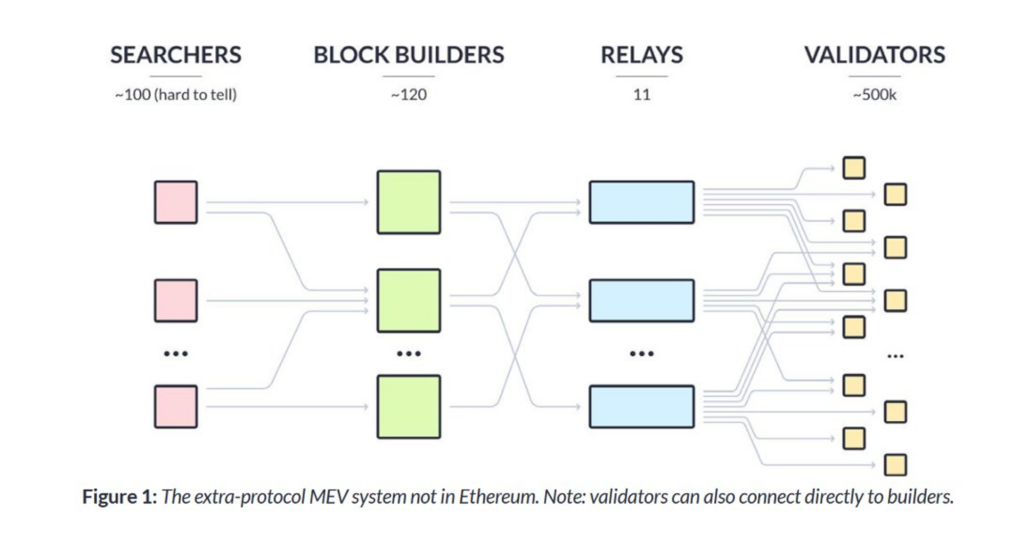

Nodes, block builders, relayers, validators, and massive amounts of capital and infrastructure flowing atop ETH will create a network so powerful it will likely be without precedent.

Above a certain dominance, this is a threat to DeFi.

If ETH grows too dominant, it will become fragile, and thus make DeFi fragile. This cannot be programmed or “my network effects”-ed away. Ethereum’s capabilities will be ruled by biological laws. Because Ethereum is an organism, and network laws are subordinate to biology.

The intellectual firepower in crypto is possibly the best in the world… but we should humble ourselves, we have not out-engineered God. Our organism is not immune from natural law and the dictates of biology. We should learn from the hard lessons of the past.

To create the most robust, functional, persistent financial ecosystem the world has ever known, Ethereum should probably have no more than 30% of total DeFi TVL. We should want 5-6 other competitive L1s, with their own validators/miners, security, settlement, etc.. to distribute risk and support our new world.

We recognize that if every Ethereum validator runs the same client (eg Geth) it presents an intolerable risk to the network, so much so that you see clients encouraging the use of their competition for the health of the network. So too should we promote the adoption of other Layer 1s for DeFi's health writ large.

Don’t view other chains as competition, view them as brothers developing and securing our new global system. Stronger together.

ADDENDUM:

This is an interesting thought experiment (at least I thought it was) that I came up with when reflecting on if someone pushed back with a "network effects disagree with you, the larger a network the more powerful it is".

The thesis of this article contradicts network power laws that basically say the strength of a network increases as its participants do. Network laws say the opposite of what I’m saying.

This is a framework I thought of while reflecting why network laws are not unstoppable forces that supersede other laws of nature, namely biological ones. Network laws must be placed in context with other natural laws.

Network laws say some variation of: the larger and more connected, the more powerful and valuable. These laws apply to blockchains, with the belief that the more validators, nodes, users, transactions, etc. they have, the more important, robust, valuable, etc they become.

There are laws of physics, laws of biology, and laws of networks.

Respectively, they are:

- laws about how the world works (physics)

- laws about how living things in the world work (biology)

- laws about how living things in the world organize themselves (networks)

I believe all natural axioms can fundamentally be placed into one of these three categories.

Examples:

- Newton’s 2nd law, thermodynamics, etc. are physics laws.

- Central Dogma, Law of Segregation, etc. are biological laws.

- Metcalfe’s Law, Reed’s Law, are network laws.

Other disciplines also fit in these categories. For instance math deserves to be included in “laws about how the world works”.

Computer science can fall into the physics, biology, or network bucket depending on what you’re discussing, etc.

What makes one group of laws superordinate to another? And why try to rank these laws anyways?

Well, what if network laws and biological laws contradict each other… which one is the dominant law?

Physics being the highest-order set of laws felt intuitively correct to me. Thinking why, I realized it’s because the other two sets of laws report to it for guidance, and have no say in how physics operates.

Who dictates to who?

Physics influences biology. Biology does not influence physics.

Biology influences networks, networks do not influence biology.

Influencer > Influencee

Imagine that the laws of physics changed or were broken, what would happen? Living things would have their existence dramatically altered, the way they experience reality would be changed based upon the changes in physics. Biology would change if physics did.

Now imagine if biological laws broke, physics would be just fine. If there was a complete suspension of the rules that govern living organisms, the laws of thermodynamics or gravity would be unaffected. Newton's 3rd Law remains intact.

Now picture if network laws fractured… biology and physics would be indifferent. If a network law was violated, the way your body worked would not be effected. Network laws have zero impact on biology or physics, whereas biology and physics impose their will on networks.

I believe this is how you determine the hierarchy of natural laws and which ones are superordinate: who dictates to who.

This law-ordering system was something I thought of while on a /nightwalk/, however I'm guessing philosophy has explored this too. I didn't look, because I didn't want any of my thoughts influenced. So just something to keep in mind. Input welcome.

To recap: natural law can be broken into three categories and their hierarchical ranking is predicated on whether a change in one set of laws would result in other laws being altered.

Follow @BackTheBunny