To understand interest rates, it’s critical to see both what informs them and what they represent. Once properly appreciated as complex-adaptive-system outputs, the Fed becomes an afterthought.

This piece builds upon the information and psychology from The Fed Part 4 and Part 5.

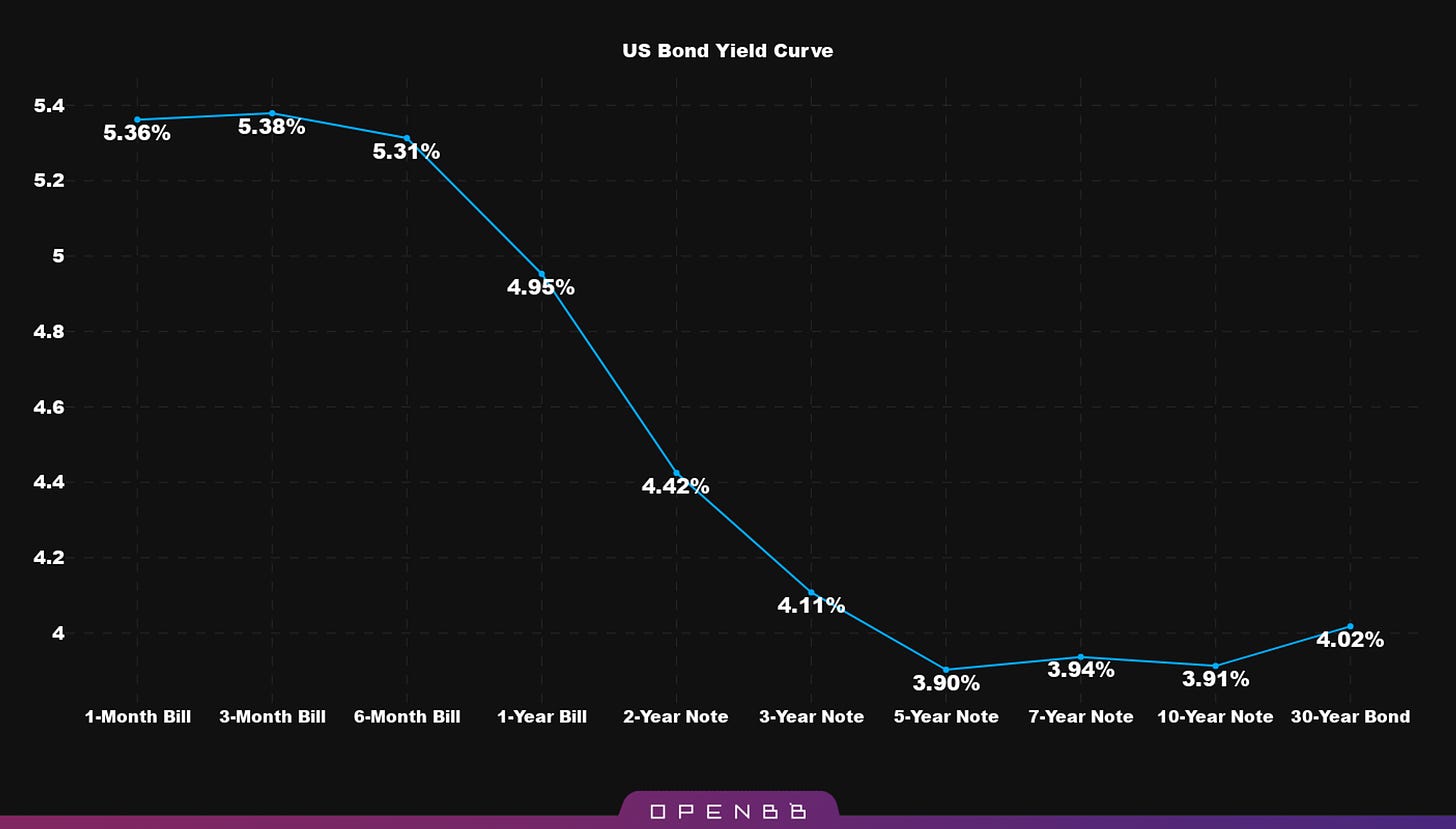

The US yield curve has been inverted for about the last 1.5 years. Short bond rates surpassing long-term ones creates an inverted yield curve; this does not portend good things for a credit-driven economy. Depending on the depth and duration of inversion, it means a recession is looming.

We associate a nice upward-sloping curve with a healthy economy. This means the 30-year Treasury has a higher rate than the 10-year, 10-year a higher rate than 5, etc.. What he have now looks like this:

This series of rates is what’s called “term structure”: it creates a visual depiction of the yield curve. All things equal, longer-term debt should have higher rates than shorter-term debt. Why is this relevant for recessions?

Envision interest rates as futures for dollars.

Just as there isn’t one price for wheat, oil, corn, etc., but prices for them at points in the future (what futures and their month of expiration are), the price and demand for dollars can be conceptualized the same way with the yield curve and interest rates: futures for dollars.

Credit creation, which is responsible for money creation, is not permanent. Dollars have a temporal nature to them. Banks issue loans, birthing new dollars in the process. Those dollars will die when debts are repaid. Money has a lifecycle.

Low interest rates are commonly associated with easy money. This is bad framing.

It’s not useful, because it gives the wrong connotation: it’s not “easy money”, it’s “low-demand” money. “Easy money” suggests the Fed decides what the cost of information should be for a complex adaptive system, which is silly and wrong. Economic tooth fairy-ism.

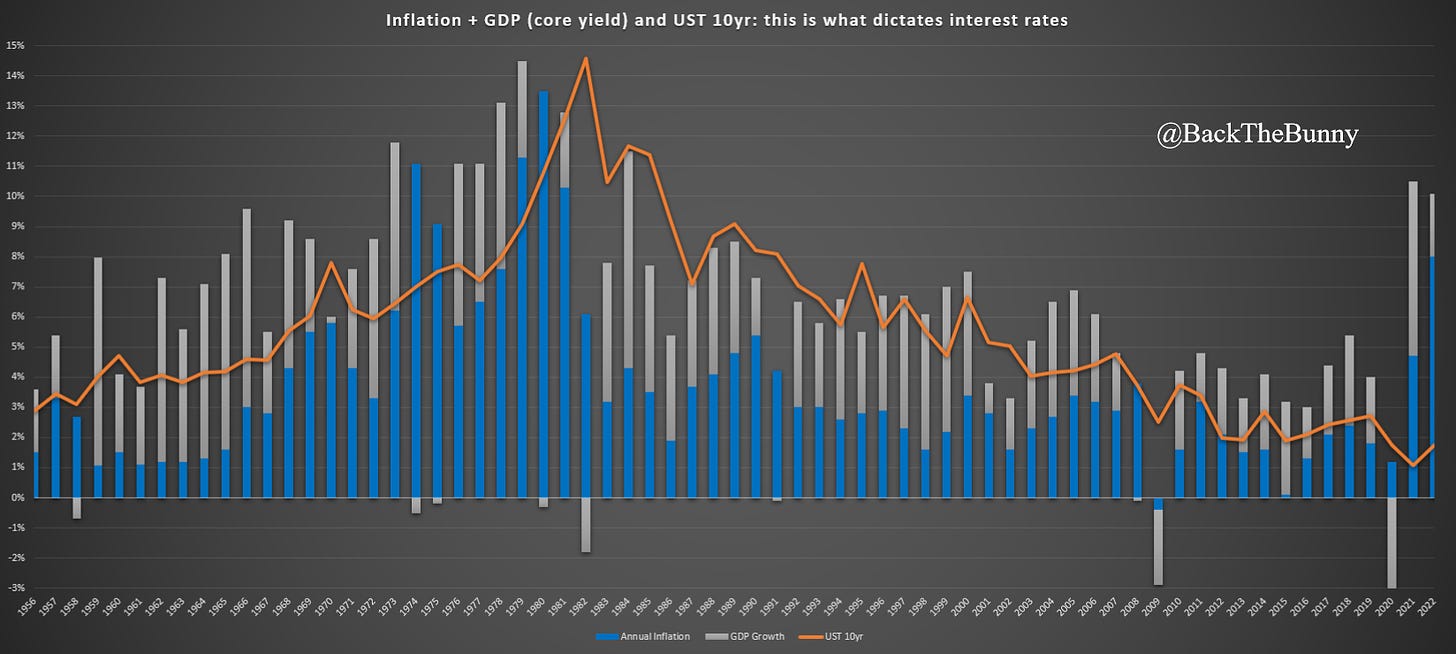

What low rates tell you is growth and inflation are low. Because rates are undeniably a composite of these two inputs. If rates are low, it means inflation and/or growth are low; if they’re high, it means one or both of these things are high. Just add them up, that’s what interest rates are. Period.

From The Fed Part 4

So with this reframing in mind: low rates do not mean money is “easy”; it means money is in low demand.

Why is this relevant for recession predictions?

View it as if you were a businessman: if you raise your price, that means you have high demand for your product. If you lower your price that’s not a good thing for your sales, it means less people are buying. This same concept applies when you’re selling debt, which is what banks do. Someone is 'buying' that credit via the interest rate they pay.

An inverted curve means sellers of money (banks) are lowering the price of their product. When prices fall further out on the curve, that means there’s less demand for credit at later dates. That lack of demand means less dollars will be lent into existence some time soon.

Since lending (credit creation) is how dollars are born, and a debt-based system needs more dollars to keep expanding… this presents a growth issue. An economy that requires a constant stream of new money to grow will have less of it at a point in the future. This is how the yield curve predicts recessions.

Think of it as a series of money lifecycles.

Money created via debt has an expiration date. Credit births new dollars.

When loans are repaid, those dollars die.

An inverted curve means not enough dollars will be born to offset the deaths.

A contraction of the money supply produces a contraction of the economy.

Economies need a blend of growing populations and money to keep expanding. An inverted yield curve is foreshadowing a decline in the money population!

Does the Fed control GDP growth and inflation with buttons? Obviously not? Excellent, so we’re agreed that their mendacious claims of interest rate control are a plague and must be aggressively ignored. This is why the conceited delusions of a government institution and what they claim authority over, the cost of information, angers me. A pathological deception that monopolizes the mindshare of everyone in finance and crypto. You don’t have to “end the Fed”, you just need to stop believing its lies.

Please like and share. And follow @BackTheBunny