There's an unfalsifiable claim regarding Fed control: “forward guidance”. It’s a magical phrase, nearly nothing it can’t justify. Markets completely ignore the Fed, yet are still somehow listening to it…

The sun doesn't follow a rooster’s “forward guidance” by rising when it crows.

Important metaphors:

A meteorologist does not dictate the weather, he comments on what’s already coming. The weather does not care what he says, and just because it did what he predicted doesn’t mean it was listening to him.

If there were people with religious zeal for meteorology and we’re assured by the Federal Department of Weather that they do in fact manage the climate (I’m sure this department will exist someday and make this claim, give it time), the weather forecast press conference would be a huge event! Will the weatherman raise the temperature or lower it? Will he bring rain? What did the meteorology “forward guidance” say this week? Have the winds and sun priced this in yet??

Now imagine a federal meteorologist who “forecasts” weather that’s already happened, then tells you his plans for the weather next week. Afterwards, everyone says he was responsible for all of it. When he gets it completely wrong, don’t worry, the weather is simply anticipating the forecast he’s going to give in the future.

I was kidding, this department actually already exists, it’s called the Federal Reserve.

We used to do the same thing with rain dances and chanting, and when a storm came attributed it to the chants. When you watch an FOMC meeting, picture a rain dance. We're more enlightened in many ways than our ancestors, but our magical beliefs about man’s control of the complex and unknown persists, even if wearing a tweed jacket while doing so.

Creationism and Forward Guidance: Unfalsifiable, Never in Doubt

Have you ever debated a creationist? It’s some variation of this:

> ”These dinosaur fossils contradict your claim.”

> ”God put them there to test our faith. God did it, just like Noah's Ark said.”

>”The millions of light years it takes some starlight to reach earth shows your theory is wrong.”

> ”God’s light cannot be measured. This is a faith test, I won’t let you shake it.”

Rinse and repeat. The tactic is obvious: it doesn’t matter what objective evidence you provide, it’s always something the deity did preemptively. Found something that contradicts God’s story? He planted it there to test you. Nothing a couple mental somersaults can't fix.

There's no scenario where hard facts refute this. It’s always God’s will. Equipped with this rhetorical tactic, you can now provide unfalsifiable post-hoc justifications for your beliefs. This isn’t an intellectual discussion; one reviews evidence, the other promotes scripture.

This creationist dedication to God’s will is the same mentality that otherwise entirely rational people have with the Latter Day Saints of the Federal Reserve. Is the bond market totally disregarding them? Faith test!

"Don't fight the Fed" is a religious incantation.

EMPHASIS: we’re not talking about a law of physics or mathematical axiom here. We’re talking about how a government institution impacts a complex adaptive system (the economy). If you think “the science is settled” here regarding how things work, you’re wrong.

Economics is, at best, an advanced logic exercise. It isn't a science because it predicts next to nothing and struggles to reproduce findings. If it’s science it has predictive abilities and is replicable. Most social "sciences" fail here.

The uniform beliefs everyone has about Federal Reserve power were incessantly injected into them via barrages of FOMC flamboyance, academic orthodoxy, and media fixation. I've yet to see opposing analysis given any credence, only “experts” that parrot 96% the same thing. There is little scientific about economics and its understanding of complex adaptive systems (to its credit, it does try). So how is there North Korea-tier consensus on the Fed? Perhaps some inquisitiveness is warranted. That's the essence of this series.

Why is the takeaway on this deeply unscientific institution -- that consistently can’t predict what it purportedly controls -- so monolithic? Why is the conclusion “they’re incompetent” and never “they’re impotent”? I believe the answer to this confusion is clear.

Fed creationism will preach the Fed is so omnipotent it makes the market do what it wants not with actions, but words: aka "forward guidance". But sometimes not even words! With…. thoughts? Because the bond market often ignores Fed declarations. In fact, it's been doing so a lot recently.

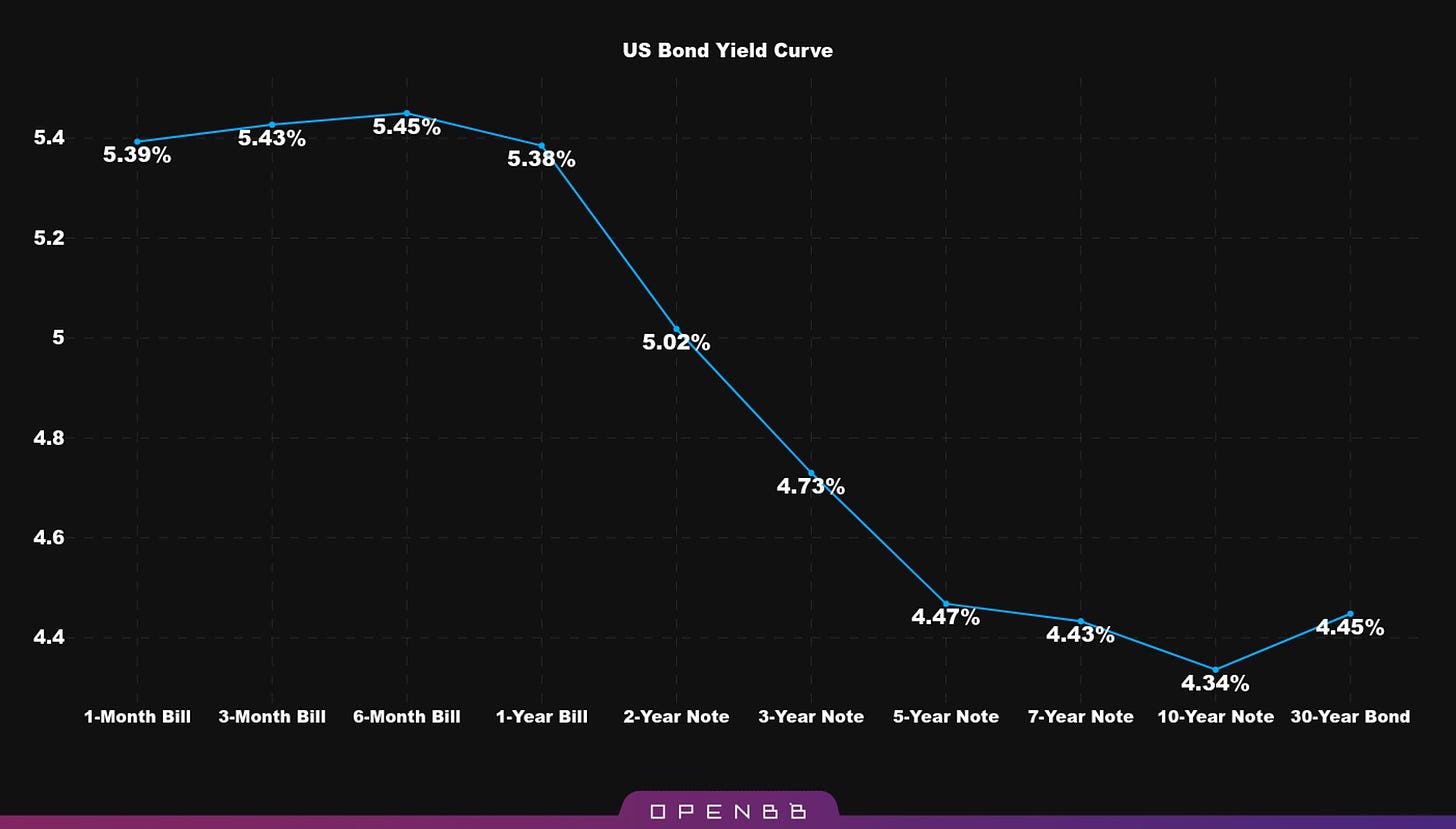

The Fed has very loudly been "raising rates" for around 1.5 years. Yet the yield curve has looked roughly like this for about a year now. This is what we call an inverted yield curve.

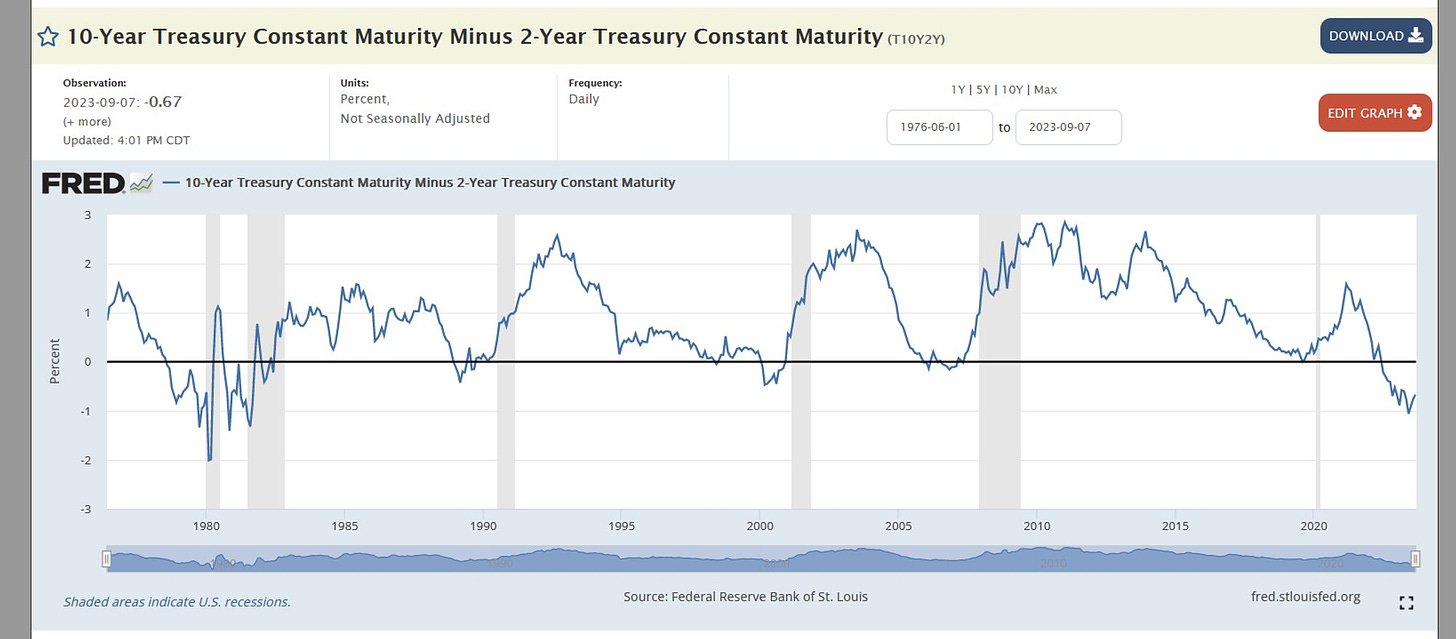

The yield curve is so badly inverted there’s only one other time it’s been worse in recent memory.

The Fed Funds Rate (FFR) is 5.25%-5.5%. The 10yr Treasury is ~4.4%. This means the rate the US government pays for 10yr debt is 4.4% annually, and the rate for overnight bank lending is ~5.35%. This is a perversion. The bond market is completely ignoring the Fed. Again.

All things equal, longer debt should have higher yields as it carries more duration and default risk (Treasurys just duration). This inverted curve is saying “we don’t care how loudly you raise the FFR, inflation and GDP dictate we’re heading lower.” (This is covered in intimate detail in The Fed Part 4).

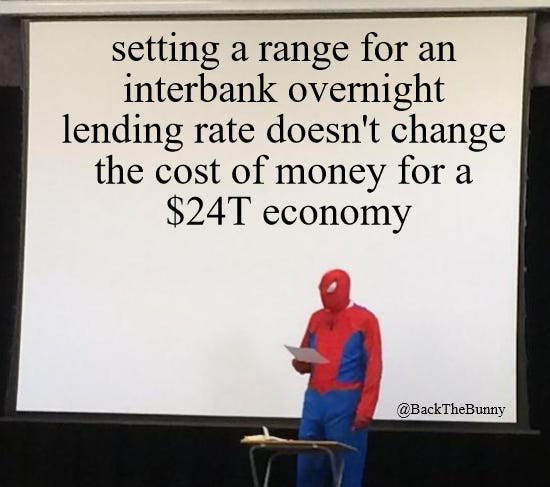

The Fed is capable at manipulating short rates (<2 years) via the FFR, which is the only rate of consequence it controls (FFR = interbank borrowing rate). What it has zero control over are Treasury bonds. Why do these bonds matter? They dictate real-life borrowing costs (covered thoroughly in The Fed Part 4).

Fed Creationism and Economic Reality

Fed acolytes will counter with a variation of:

“Bonds are still listening to the Fed actually. They're predicting the Fed will cut rates. They’re anticipating what the Fed will do in the future, even if the Fed says it won’t do it.”

Let’s be clear: the Fed is saying and doing one thing. The bond market is subverting it completely, and yet the bond market is still somehow under the Fed’s will by predicting what it actually will do in the future vs what it says….

Creationism. This is “God did it-ism”. Magical thinking.

The observation consistent with reality is that the bond market is doing what it does based on economic facts (GDP growth + inflation) and it doesn’t care when the Fed and its lagging indicators realize what it’s already figured out. The Fed tags along. Followers.

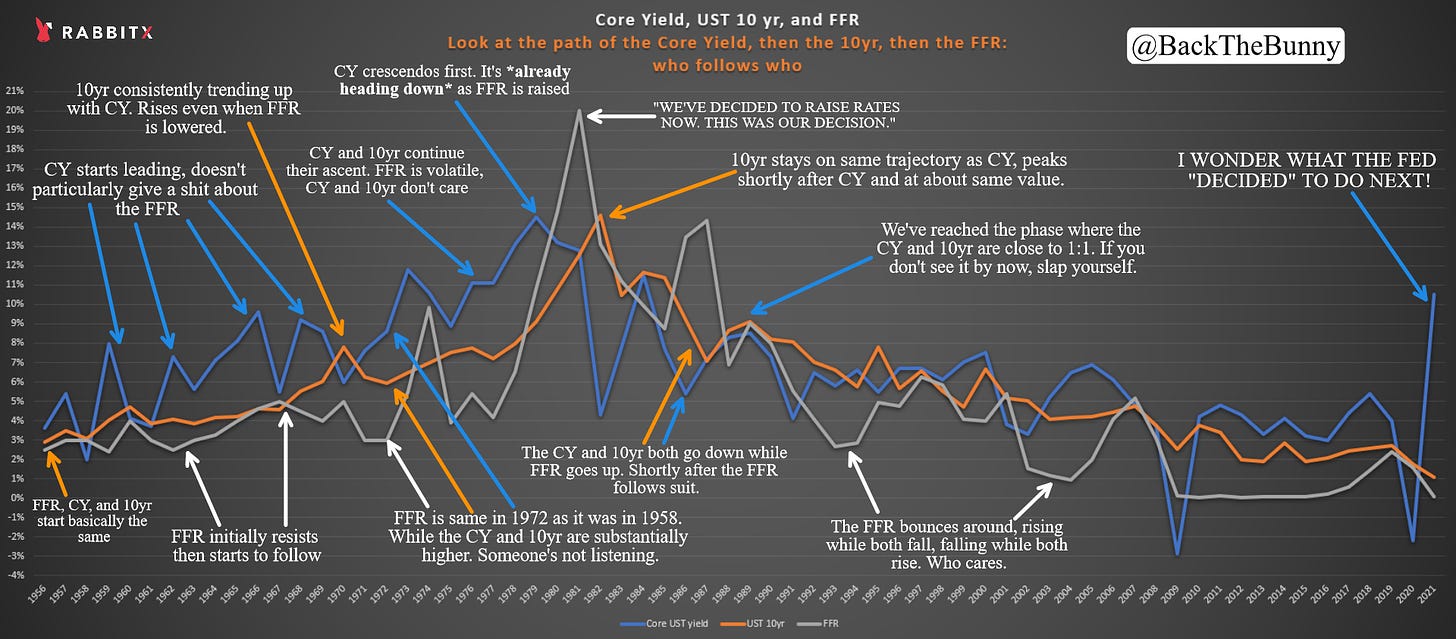

Here’s GDP growth + inflation and the 10yr Treasury going back 70 years (look at the end when inflation + GDP spiked, I wonder what the Fed “decided” to do next):

The answer is not that bonds are somehow predicting Powell’s next moves, even when he says “we’re not going to do those moves.” If you consult interest rate breakevens they tell a similar tale on inflation. Because they operate in reality, not 12 people's delusions of grandeur.

Complex Adaptive System Philosophy: The Price of Information

There is no more critical, indispensable financial input than the cost of information. This dictates resource allocation, which dictates economic activity. This is what interest rates are.

Money flows (information) are directed by them. Vast amounts of economic data are embedded within them. Interest rates are the price of resource information. Economies are complex adaptive systems. Their most vital input and output are interest rates. When it's internalized that the most critical input AND output of a vastly complex adaptive system is not in any way something a panel of 12 guys control with buttons.... then this series and evidence I've compiled will begin to make intuitive sense.

It's fundamentally communist thinking to believe you can (or even should) control resource distribution, information, for a complex adaptive system. Our simple monkey minds can't govern it. For similar reasons, you also shouldn’t manage the weather. Your models are lovely but I'm sorry, no. I’ve written on complex adaptive system management and folly previously.

The Fed is dressing up the same "state employees allocate resources better than the economic system" thinking that a communist-led economy has when they say "I will make interest rates be X today". They're just doing it with optics that present differently to the uninitiated.

It's revealing to me the communist undertones that the Fed/the West have when they believe they even should manage rates, independent of if they can. Pure hubris. USSR lite. Thank god they can't. But still, identify this thinking for what it wants to be: very bad.

Fed Forward Guidance: A Tragic Comedy

Now let’s look at some recent examples of reality calling the shots and how “forward guidance” Fed creationism is about as useful as tabloid gossip. We’re going to simply observe the world around us, what the Fed explicitly says, and what the market does.

I have receipts for all of these. I literally went back and hunted out articles, press conferences, statements, etc. and took out these headlines. When you see it, you can’t unsee it.

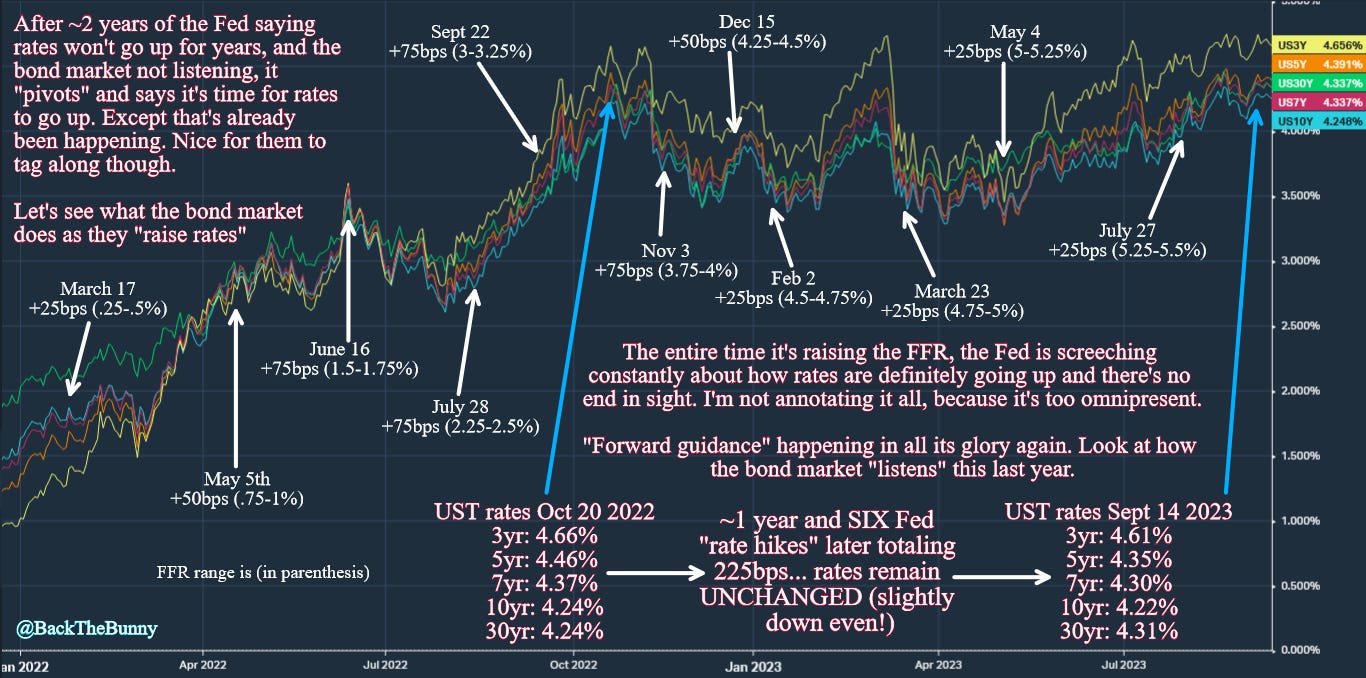

Rates persistently go up while the Fed howls rates won’t go up for many years. I get we're starting from a low base, but those increases during strident insistence otherwise from Powell and Co don't lie. Look at how all that "forward guidance" is respected and guides the cost of money.

To be fair, I showed the delta between when rates bottomed vs when the Fed “pivoted”, then the delta between the "pivot" and the first FFR increase. Does the trend look different to you? Because it sure looks like a continuation of what was already occurring to me.

What was the bond market pricing in while the Fed said "don't go up"? Inflation! Because that’s what informs the price of money: inflation + GDP growth. This is incontrovertible reality.

Now that they’ve been “raising” rates for 1.5 years, let’s check in on how those rates have reacted. With the Fed hiking so aggressively, we ought to see that in real life right.

Nope.

Markets are reflexive beasts. The Fed's cognitive stranglehold dominates psyches, but it has little power outside of a belief it has power. Just press conferences and fan fare, no transmission mechanisms.

I reiterate: what was going up the entire time? Inflation. History shows macroeconomic variables no man controls are the maestro

Here’s 70 years of the 10yr UST, FFR, and the Core Yield (sum of GDP growth + inflation):

Meteorologists don't get credit for controlling the weather by making forecasts. Roosters don't "forward guidance" the sun by crowing before it rises. You have the sequence exactly backwards when you believe otherwise. Monetary policy is when you think the rooster is powerful.

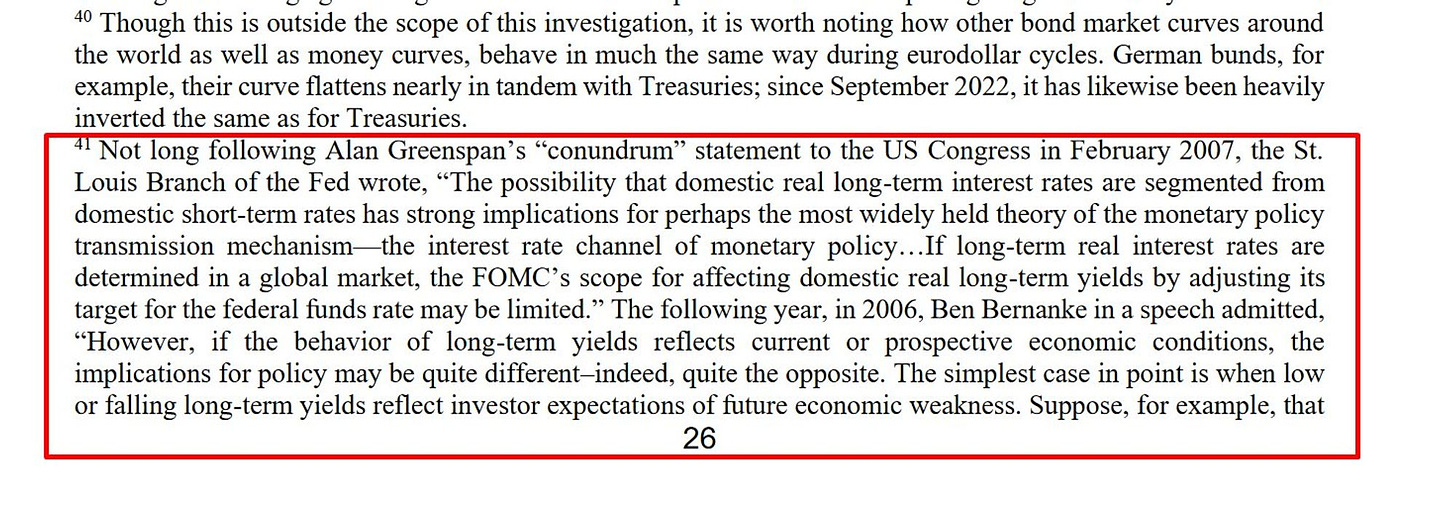

I encourage you to really internalize those charts. Give them all a 2nd look. View things from a true first-principles lens when you do. If no one told you want to think, what would you think? Even the Fed has quietly expressed concern (“conundrum”) over their abilities here...

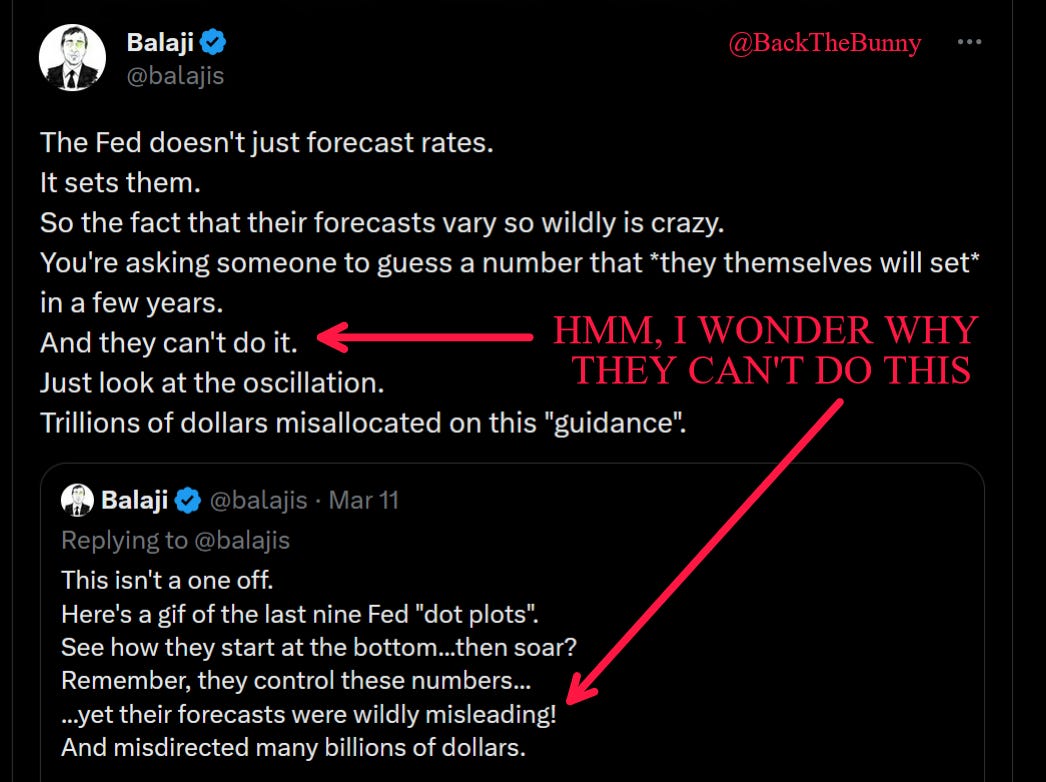

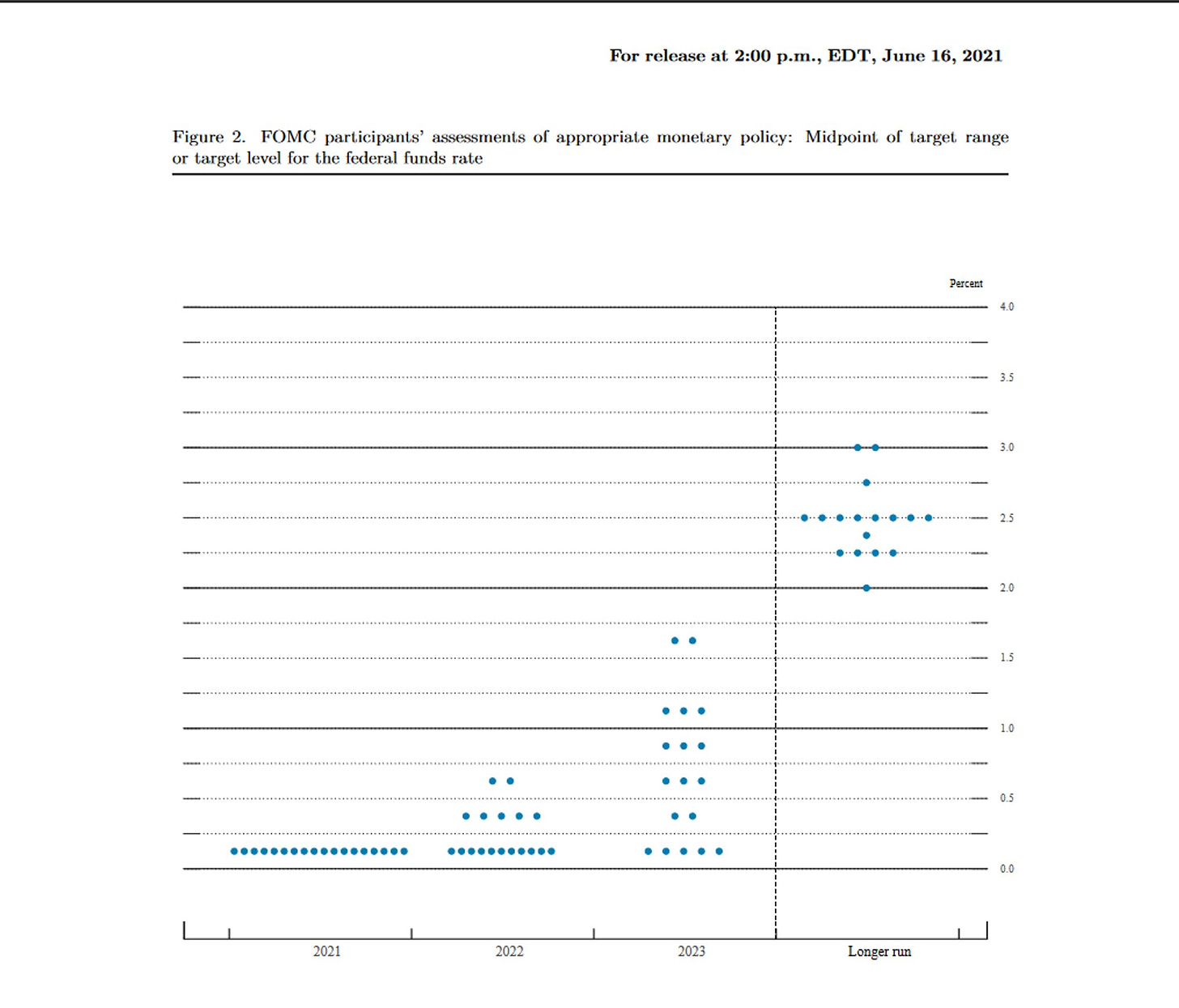

“The Fed gives forward guidance that broadcasts these moves years out. This is how they lead the bond market from behind. Have you heard of the Dot Plot?”

Yes, the Dot Plot. Where they concretely tell you "this is where the thing we control will be set." The Fed’s Dot Plot (DP) shows each FOMC member’s forecast for rates; the dots represent what they believe the FFR will be at the end of each year for the next three years.

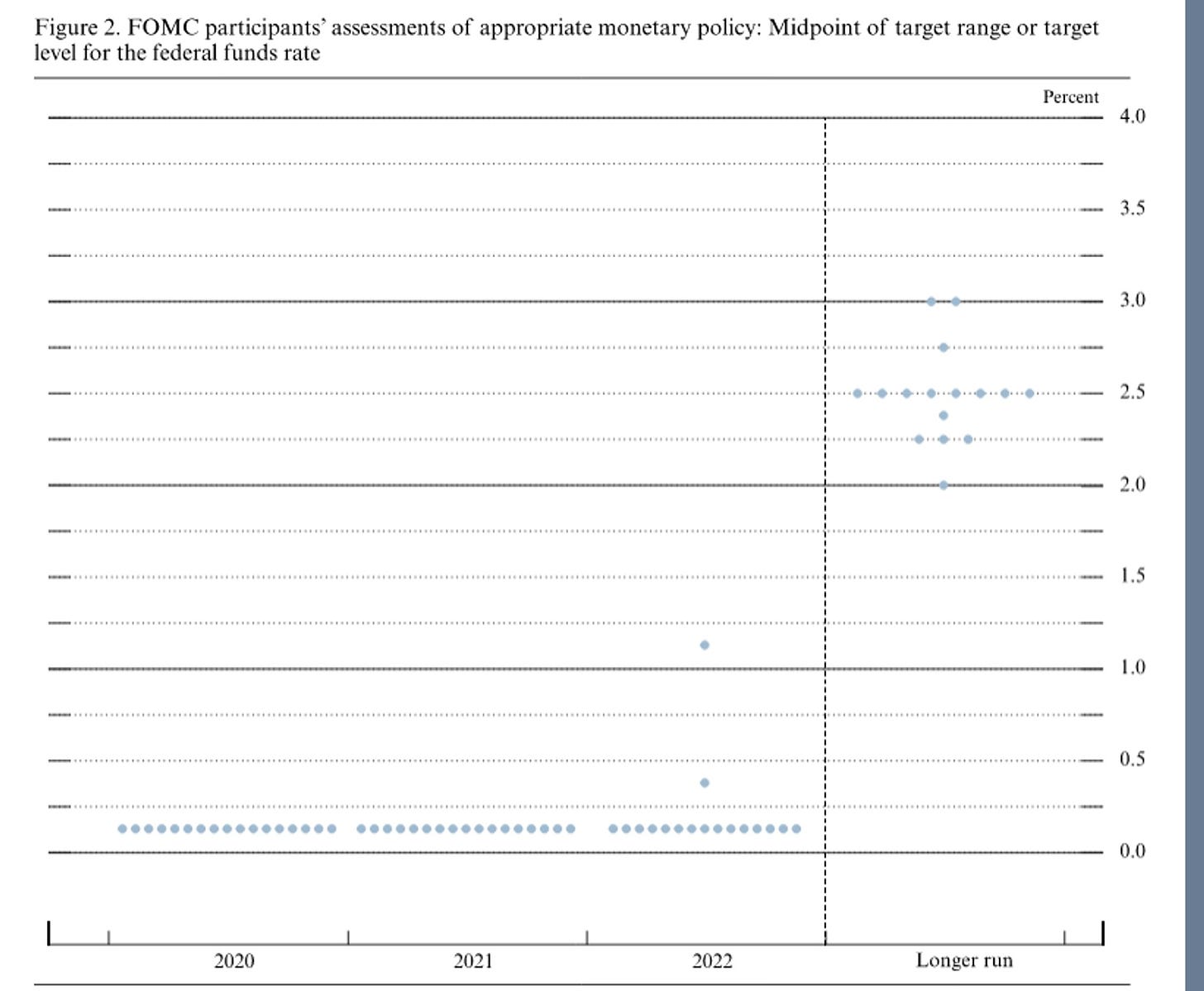

Take a look at what the Fed explicitly broadcast in a “forward guidance” kinda way in June 2020. Rates at ZERO from 2020 - 2022.

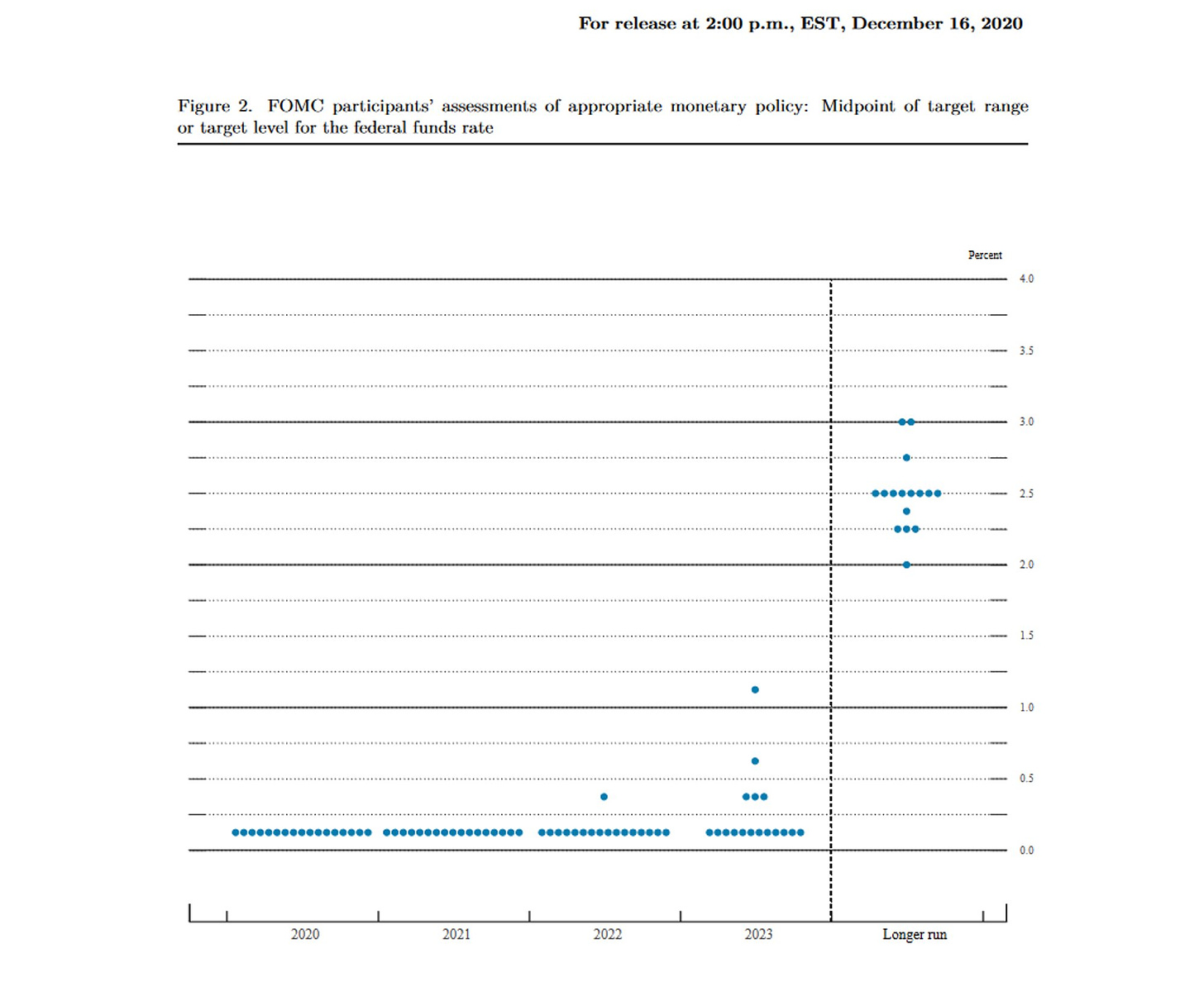

Dec 2020 Dot Plot: by this time rates were clearly trending up. Look at this, then go look at the previous charts, and tell me who controls who. The market knew raising interest rates was what the Fed really wanted even while the Fed said the opposite, or...?

Interest rates at zero through 2023!

June 2021 Dot Plot: as rates rose and consolidated, then went higher again. The Fed still saw rates at basically zero in 2022 and ~1% by 2023. The bond market must be absorbing the Fed's will via clairvoyance.

These Fed Dot Plots would have been more useful as kleenex. I’m being forceful here because it’s warranted when you’re attacking institutional-grade deception. This should be jarring and a little disorienting to internalize. Disrupting priors is not done meekly.

The institution that “controls” rates can’t predict them to save their lives, and it’s because they don’t control them. This would be obvious for any other profession or government agency, yet it's heretical here. No. DO NOT MAKE EXCEPTIONS TO STANDARDS OF PROOF. If you’re reading me, you’re probably at least a little based and not the biggest fan of the federal government, so don’t be an apologist for a government institution. Disrespect it when it repeatedly demonstrates it deserves it. Become a Fed Disrespecter.

I have a question: what more do you need to see? If you've read my entire Fed series so far and still have the same views on this institution as a Davos attendee or CNBC host... are you able to have your mind changed? Ask yourself “how could my mind be changed?”

If you can’t think of a way your faith could be shaken… something to reflect on. Are you operating on evidence or faith? Never be the creationist. How much do you trust MSM, the government, and social-science academia to impart the truth to you? Apply that consistently to the Fed now.

When you encounter an unquestionable truth no one dares doubt, it’s probably where inspection is needed. Unless it’s regarding a hard science, humans collectively do not naturally come to monolithic conclusions unless religiously inspired. Especially on complex adaptive systems.

This Fed series emphasizes psychology and logic just as much as data and evidence. Because again, economics is a logic exercise. Econometrics are mostly post-hoc justifications for beliefs derived by logic and ideology. It's important you see both my logic and the data in service of it.

I haven’t posted the Fed parts Zero - 3 to my Substack yet, you can find them on Twitter (links in The Fed Part 4). I’ll be posting them on here soon.

Thank you for being curious with me. Please share. Spark a conversation.

Follow @BackTheBunny