Quantitative Easing (QE) does not print money. It does not create new assets. It does not inject dollars into the world that consume resources. It isn’t responsible for asset prices going up. I mean this technically and literally. Each of these claims will be methodically deconstructed and defended in this essay, among others.

The Fed’s QE “money printer” is a misleading manipulation. The word “liquidity” is tossed around whimsically these days, predicated on simplistic observations that essentially boil down to looking at the Fed’s balance sheet and whether stocks have gone up or down; up is a liquidity, down is a less liquidity. In specific detail, we’re going to review why this is mechanically not the case. We’re not relying on hand-wavey academic theory, this is a raw operational breakdown as to why QE is flamboyant placebo effect.

If you’ve been following me on Twitter this past year, you may have seen a fairly popular thread put out by me that echoes some of these sentiments; this essay is not just a recapitulation of this. You’ll find new information and concepts in here to illustrate why you should become a Fed disrespecter. The only power this institution has is the illusion of power.

Psychological Precursor

Understanding information is one thing; internalizing it is another. The right mentality is critical for absorbing the information in this series. For the same reason that if you grew up in the USSR and I was trying to inform you that the The Great Soviet Encyclopedia (a real thing) had propaganda in it that wasn’t exactly true, you’d be in no state of mind to receive that message. If you want to get to the mechanical arguments, you can skip to the next section. But I encourage you to read and reflect on this part as well.

Almost everything the Fed does is some combination of propaganda and chart crime. All central banks are simply big asset-swapping machines; never creating new assets, just shifting compositions around in the hopes it excites you. Monetary policy is roughly 90% shuffling compositions of bank balance sheets and then holding a press conference telling you something big just happened.

This is not lost on FOMC members and their omnipresent press conferences and interviews (go one week without a Fed member doing a CNBC interview or press conference, challenge: impossible).

"I think monetary policy is 98% talk and 2% action.” - Ben Bernanke

Actual power: “Speak softy and carry a big stick.”

Fake power: “Speak as loudly as you possibly can, shout until your hoarse, and hope they don’t make you break out the twig.”

(Side note: if your response to this is “forward guidance”, read this afterwards.)

When discussing the central bank, everyone is primed in a very religious sense that you “don’t fight the Fed”. You’ll hear the same fear-based, unquestioning maxims from a Catholic who inculcates “don’t question God’s will”. When you see an FOMC member speaking, please picture a priest.

Ask yourself:

“Do I have the same beliefs about the Fed’s indisputable power as everyone at Davos, CNBC, The Economist, and every Fed employee?”

I bet you mostly do.

Now ask yourself:

“This priest-like Davos class and federal bureaucrats, the ones that are blatantly political and ideologically motivated, with obvious agendas that lionize and extol centralized power… do I trust anything else these people tell me?”

I bet you mostly don’t.

No one ever thinks propaganda works on them. Yet we all know that it does indeed work.

The Fed is a government institution making absolutely insane claims about what it’s able to do, and you accept this at face value? Why?? It’s not a law of physics we’re inquiring about here, it’s one of the most non-scientific fields around (economics) making incredibly squishy claims that basically no one verifies. You can question this, it’s okay.

Extraordinary claims require extraordinary evidence.

You have exactly the same beliefs about the omnipotent magical institution as the people who maintain and promote the omnipotent magical institution. Everything you understand about the Fed comes from those who exist to defend and promote the power of the Fed.

Do you expect intellectual honesty and frank analysis from those whose financial personality is devoted to the institution in question? Have you EVER seen a “Can the Fed actually do the things it claims it can?” panel on any of these media outlets? Why?? Because it’s just so obvious, right.

Austrian "End The Fed” types and neoliberal central planners are two sides of the same coin: neither doubt the majesty of the divine institution; the only disagreement is whether it wields its power for good or evil.

It’s an example of Horseshoe Theory no one notices:

“The Fed is all powerful, that’s a good thing.” - Neoliberal Keynesian

“The Fed is all powerful, that’s a bad thing.” - Austrian Bitcoiner

I encourage you to approach this Fed series with a fresh mind, and put aside what you've been duly informed is happening. Let’s look at raw mechanics for what they are, and not for what you’ve been told they are.

Quantitative Easing and M2: A Deconstruction

First we must clarify how money is reported**.** M2 is what’s commonly referenced by economists to quantify the money supply. Here’s what it entails (everything in M1 is included in M2):

Please note: nowhere in here are bonds.

What QE technically does: QE is when the Fed buys bonds (typically Treasurys, sometimes MBS) from banks. The Fed simply takes the bonds off the bank’s balance sheet (BS) and gives them a commensurate amount of bank reserves. The bonds then go onto the Fed’s BS. Quantitative Tightening (QT) is the inverse of this.

Example: a bank has $1B of bonds, please instead view this as $1B in ASSETS. After QE it no longer has $1B of bonds, it has $1B of reserves. However the $1B it has in total assets is unchanged.

IMPORTANT:

- The bank still has $1B in assets. The total assets the bank owns didn’t change from QE. I can’t emphasize this enough.

- Banks issue loans against BS assets. Their capacity to lend is effectively unchanged after this swap game.

- QE made no change to the total assets the bank holds or can lend against, it simply modified the composition of its BS.

What you just read is what everyone universally and very passively describes as “money printing”. This deconstruction is much less sexy… but it’s precisely what happens.

But look what QE swap games did to the M2 chart! Remember bonds are not a part of the M2 calculation, but bank reserves are. The amount of assets in the world are identical, but the M2 chart just had a full-on panic attack. You see the psychology at play here…

QE Properly Understood

Banks keep their reserves and Treasury bonds at their regional Fed bank.

This is how you can accurately conceptualize this:

- Bonds are effectively a savings account for the bank at the Fed. Assets that pay interest and are not what’s used for clerical stuff like wire transfers, withdrawals, etc.. The same way you wouldn’t use your savings account to pay for groceries.

- Reserves are effectively a checking account for the bank at the Fed. When the bank facilitates a withdrawal, wire, etc. it comes out of here.

If your bank swapped your savings account for a checking account, are you richer? Do you have new “liquidity” to go do things now? This is not overly reductionist or an apples-to-oranges analogy; there is no real change for a bank or for you to do things you already could or couldn’t do if you change your savings account to a checking.

These savings/checking swaps have zero impact on macroeconomic reality. The stock market is not all the sudden flush with “liquidity” because bank bond and reserve balances shifted internally at regional Fed banks. This is not a colorful metaphor, we’re being deeply literal here. No more “liquidity” platitudes.

QE reorganizes part of a bank’s balance sheet, that’s it. And because of how M2 is calculated, it completely distorts the perception of what just happened. Psychological games.

When Printing $10 Trillion Creates No Inflation: Real Money Must Be Able To Consume Real Resources

I want to emphasize my use of the word “reserves”. Bank reserves are not money, they’re akin to interbank settlement tokens that banks use for things like repo or withdrawals and wires of customer funds, etc.. Withdrawals/wires are providing money that already exists, it isn’t new money.

“Printing money” is actually printing money when it births new dollars into the real world that can consume resources.

A simple illustration: if I print $10 trillion and bury it 100 feet below ground, the M2 chart will go nuts! People will lose their minds, look at all the new “liquidity”!

But there will be zero inflation from it. The money must exist in economic reality (in accounts that can spend it), where those dollars can now chase the same resources for “money printing” to have happened.

When the Fed does its asset swaps, that money is not money; because it’s not in economic reality, because it cannot consume resources. Interbank settlement tokens are not money.

You know they’ve been doing QE since 2008? Printing trillions of dollars should produce inflation right? Right.

The Death of Fractional Reserve Lending

We’re all aware of the concept of fractional reserve banking, but did you know it’s a dated academic concept that has almost no bearing on banking reality?

Banks simply will money into existence with the stroke of a keyboard when they make loans. If the bank needs to hold some reserves to back the loan (this is a regulatory requirement, not a bank decision), they go into the Fed Funds market (interbank reserve lending) and borrow the reserves after the loan is created (they have 2 weeks to do this).

Banks do not receive reserves and then lend them out; they quite literally create new money (loans) as they see fit (loan officers are the real money printers). Then they borrow reserves after if needed for regulatory purposes.

Understood properly, it’s reasonable to think that giving banks more reserves could in theory facilitate more lending. However this is not happening, for two very important reasons…

Reserve Requirements Are Not a Thing

Banks don’t lend out reserves, they lend against them. But they only need them if there are a reserve requirements.

A list of countries with 0% reserve requirements and the year they eliminated them:

- US (2020)

- UK (1981)

- Australia (1988)

- Canada (1992)

- Denmark (2018)

- Norway (unsure)

- Hong Kong (unsure)

- New Zealand (1985)

- Sweden (1994)

- In the EU, it’s a whopping 1% since 2012

I couldn’t find a wealthy-ish western country with any kind of real reserve requirement (Iceland at 2%, watch out!).

I want to elucidate how absurd this is in light of what the Fed does with QE:

There are zero reserve requirements for banks in the wealthiest countries, including the US. Many have not had them for decades.

Banks are by definition not constrained by reserves for lending if their reserve requirements are 0%. RESERVES DON’T MATTER FOR LENDING IF YOU DON’T NEED THEM TO LEND.

The central banks flood the interbank lending market with reserves via their QE so the banks can…. lend more? What?!? They give them more of the thing that wasn’t limiting them to encourage the loans they aren’t making.

It’s time we stopped pretending that having a bunch of PhDs on your payroll necessarily produces something coherent or useful. I have nothing respectful to offer here. This is inane.

(If you’re thinking this is a quasi way of monetizing the debt, you can read this brief essay I wrote in response to Balaji on twitter.)

QE swaps bonds for reserves. The banks cannot lend out the reserves, they can lend against them functionally the same as the bonds. And the reserve requirements are 0%, so the reserves make no difference because they have the same amount of assets after QE or QT.

This is a prime example of why this institution deserves your contempt. The Fed should not be feared, it should be mocked.

You don’t need to “End the Fed”; you just need to stop believing its lies.

Trickle-Down Liquidity? 2nd-Order Effects?

Even though banks don’t need them, maybe all those reserves somehow galvanize banks to mint more money? It would make no sense, but perhaps there’s a psychological effect that prompts banks to lend, which does create new money that consumes economic resources. Banks are the real money printers because they actually birth new dollars into the real world.

Nope.

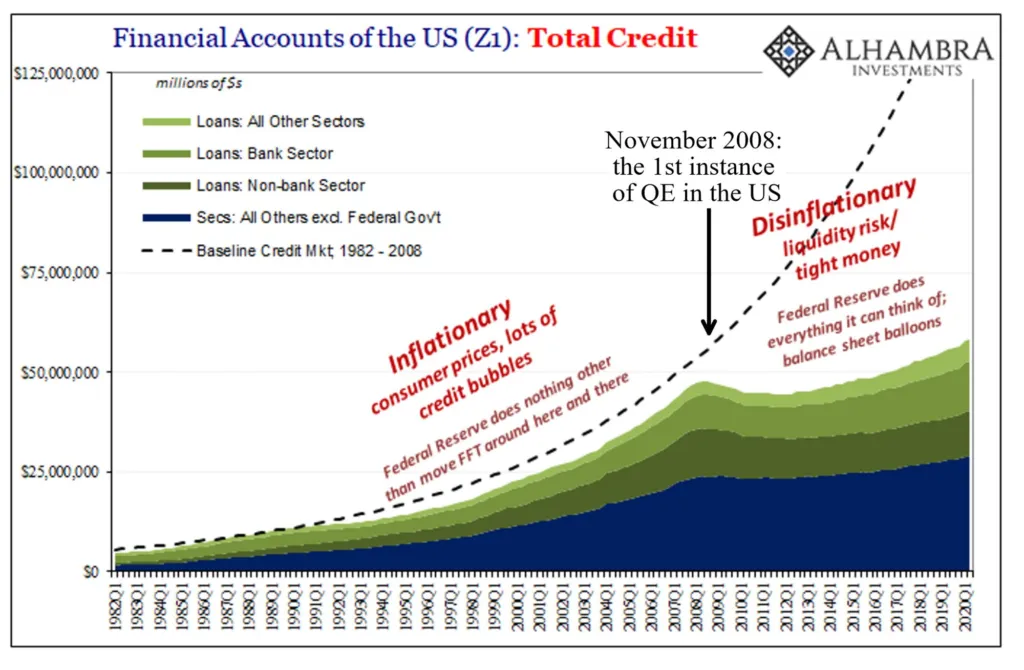

As shown in the Z1 data below, the credit creation trajectory has actually decreased since the Fed has routinely been doing QE. If QE was somehow juicing lending that had trickle-down impacts on liquidity, this chart should not look like this.

Chart courtesy of Jeff Snider and Eurodollar University

So QE mechanically can’t create real money, and it’s not resulting in banks creating more money, either.

I’m not playing semantics or cherry picking obscure things; I’m not caviling over minute details to defend a differentiated hot take. I’m being deeply literal about explicit assertions, accepting zero platitudes, and figuring out how a falsifiable claim actually manifests in reality (this is what treating something like a science looks like).

We’re not accepting “expert” theoretical descriptions of how an engine works; we’re opening the hood and taking it apart ourselves. And it turns out we were lied to: Fred Flintstone doesn’t actually stick his feet onto the road and “yabba dabba do” the car forward. The engine has spark plugs, pistons, all kinds of stuff no one bothered to tell us about. There will be no more Yabba Dabba Doo theory of money printing.

So What Constrains Bank Lending?

There are two things broadly that do.

Capital Adequacy Ratios: These are measures to ensure banks have enough capital relative to their assets to absorb losses. It considers a bank’s Tier 1 and 2 capital (mostly common and preferred shares, retained earnings, and some forms of subordinated/hybrid debt issued by the bank), and is calculated by dividing the sum of Tier 1 and Tier 2 capital by the bank’s risk-weighted assets. This restricts the bank’s lending activity.

Liquidity Coverage Ratios (LCR): This makes banks hold a sufficient amount of high quality liquid assets (HQLA) that can be readily converted into cash during periods of financial stress. It measures a bank's ability to withstand short-term liquidity shocks by ensuring it has enough HQLA to cover cash outflows (eg can it withstand a bankrun). The majority of HQLA consists of cash, reserves, and government securities. Stocks make up less than 1% of a bank’s HQLA.

Why do I share this:

- To again reinforce how reserves are not restricting anything the bank wants to do. If you’ll notice for the LCR, reserves and government securities are both part of a bank’s HQLA; so swapping one for the other isn’t helping.

- Capital adequacy ratios don’t consider reserves at all.

- To refute the “asset price inflation” story. Look at the HQLA components, stocks are less than 1% of it. Banks are not taking their reserves and bidding up the Nasdaq, because they legally aren’t allowed to. Stocks basically have zero weighting in LCR calculations because they’re considered too risky.

So how is all that QE “liquidity” getting into stocks? It isn’t. It’s something else.

There is no pipeline from QE bank reserves to “pumping the stock market”. If there’s a concrete claim that one thing impacts another, then there is a mechanical explanation through which something in one spot gets to another to impact it. There is no such explanation here, because there is no such path.

QE and Asset Price Inflation: Disregard Japan

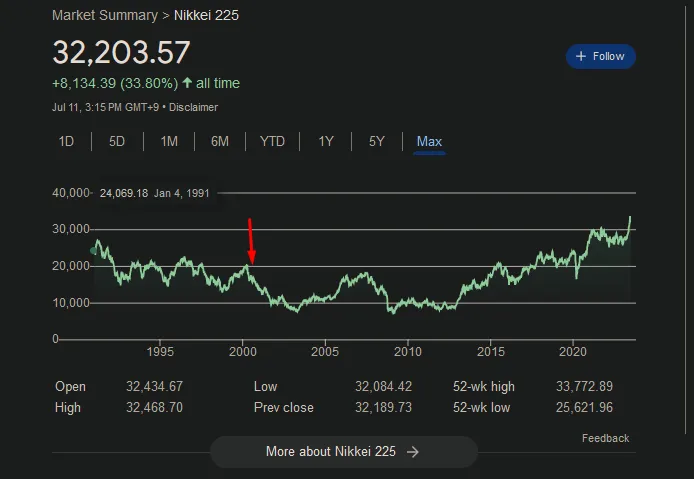

Lastly, one of my favorite refutations to the asset-price inflation narrative: Japan.

Japan doubled the amount of reserves in its system in the early 2000s. Doubled! They’ve done way more QE over the last 20+ years than the US (who started in 2008).

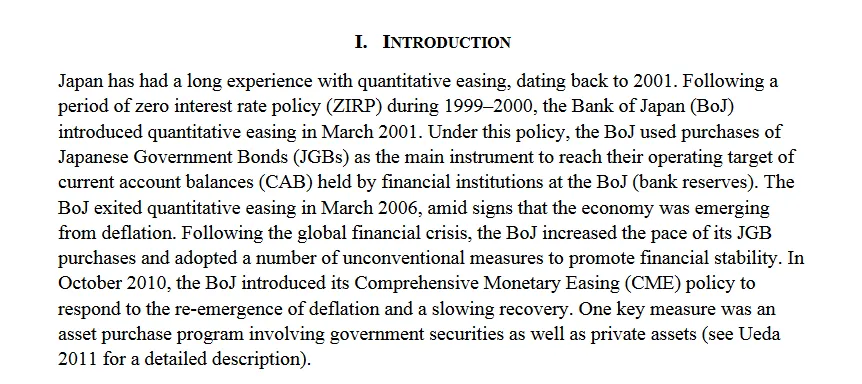

Japan started doing QE in 2001:

The Nikkei since Japan has been doing god-mode QE:

Also, credit creation went down during the earlier parts of 2000 while Japan doubled the amount of reserves in its banking system. If QE was juicing assets, you should see it in the country that has done by far the most of it.

A parting fact:

97% of the money supply is created and allocated by bank loan officers for the benefit of the bank. Banks create the money supply. The remaining ~3%? The Fed/cash.

Bank loan officers are the unsung money printers that get no credit for their printing.

In Part 2, we’ll discuss why the Fed’s balance sheet is an accounting fiction that does not exist in financial reality. Something I call The Graveyard Balance Sheet.

Thank you for reading and being curious with me. Please share and subscribe.

Visit RabbitX.io

Follow at @BackTheBunny