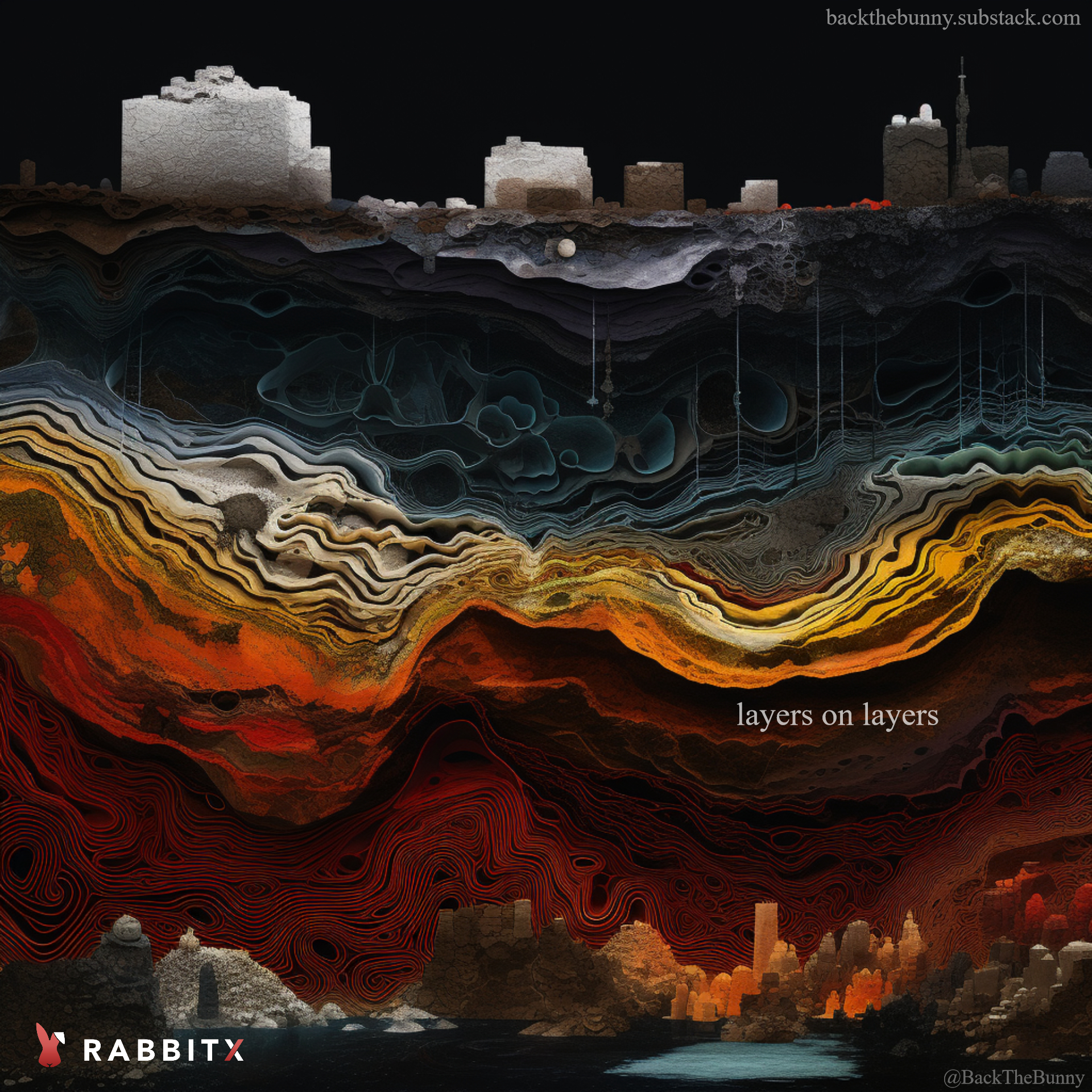

Money seems like a straightforward thing. However DeFi has shown us it can be a deeply philosophical question: what is money? A unit of account. A medium of exchange. We know the definitions. However the proliferation of things like algo stablecoins and wrapped tokens have forced us to hone down on where the value of the asset actually lies. Can you collateralize digital bits with more bits? Or must your bits be collateralized with atoms that exist in the physical world? What makes certain atoms/bits money and others not money? Just like there are layer 1 and layer 2 blockchains, there are layers of money that act as substrates for more money.

-- LAYER 1 MONEY --

Historically, the base layer for money is often a commodity. Up until 1971 it was gold for the US dollar. In crypto, Bitcoin is our digital gold. What’s it do? Stop asking questions and hold it, that’s what it does (we love the corn fwiw). The base-layer asset used to be something tactile that you could drop on your foot, however it’s difficult to transact with it for this reason. Purchasing something in gold is highly impractical. So, we must abstract another layer onto things for usability.

-- LAYER 2 MONEY --

US dollars were once an IOU that could be redeemed for gold; this made the USD a L2 money built atop gold’s L1. However the US government opted to remove the gold base layer in the infamous year of 1971, and now we have L2 money masquerading as L1, also known as soft currencies. You could think of the US military as the new base layer for the USD. The US military isn’t a Proof of Work protocol, it’s Proof of Violence. The world’s largest violence network, which ironically uses more oil than any other institution on the planet. And they say Bitcoin is bad for the environment.

You could also view coercive taxation as the USD baselayer; you have to tithe in it, so you must work and earn it. Taxation is a necessary condition for a soft currency to have value. Layer 2 crypto money comes in several forms. BTC deposits held on centralized exchanges (offchain) are effectively an IOU for onchain Bitcoin. This also includes lending platform deposits (eg. BlockFi). There are different risk considerations behind the scenes for L2 crypto money, typically represented by the yield you’re provided for holding it on the platform (the higher the yield, the greater the risk). Tokens like WBTC (wrapped Bitcoin) are another version of crypto layer 2 money. Bridging your Bitcoin to Ethereum creates an asset whose sole value is that it represents a demand deposit on the bridge that’s holding the actual BTC.

-- LAYER 3 MONEY --

Prior to 1971, USD was an IOU for gold. When you deposited your USD into a bank, that deposit became an IOU for dollars; the bank deposit is the L3 money (2 different IOUs to get to the baselayer). If you understand the US military as the USD’s baselayer, the dollar’s L3 is still represented by deposits at banks. Bitcoin’s L3 is found via DeFi applications like Yearn and Aave. With your WBTC (L2 money) you can then deposit into a yield-farming vault. This gives you tokens like yvWBTC, representing yet another demand deposit, which is the L3 money (2 different IOUs to get to the BTC). Layers on layers.

-- LAYER 4 MONEY? Sort of. --

A possible Layer 4 for dollars is an esoteric and underappreciated one. The eurodollar market is a ledger-money system that represents USD held by banks outside of the US, meaning beyond the purview of US regulators and the Fed. These deposits are then lent out, repeatedly, creating many, many more dollars. How many times is the same dollar rehypothecated? It’s estimated up to 20-30x, but with the opacity of the eurodollar, we can’t know for sure. It’s a true wild west of dollars. No one wants actual dollars in this market (meaning physical currency) they just want keystrokes in their account that give numbers that represent dollars. And that's good, because there’s nowhere close to 1:1 USD backing those eurodollars. We have no idea how large the eurodollar market is because it’s unregulated with no formal reporting. It’s estimated to be at least as large as the domestic US dollar market. Stablecoins have interesting parallels to eurodollars.

@BackTheBunny has analogized them in previous writings as sovereign money market funds. Another way to interpret them may be as cryptodollars. Like an onchain eurodollar. Take Tether’s USDT. USDT’s reserves are held outside of the US banking system, and USDT represents a demand deposit on these offshore US dollars. Tether says they’re 1:1 backed, however there's well-known uncertainty to just how backed all that USDT is. The framework to eurodollars is similar.