Markets have crashed while inflation and interest rates rose concurrently. When there's a bear market with rising rates and inflation, what has market recovery been like historically? Not all crashes happen in this kind of scenario.

I pulled some data, here’s what we found.

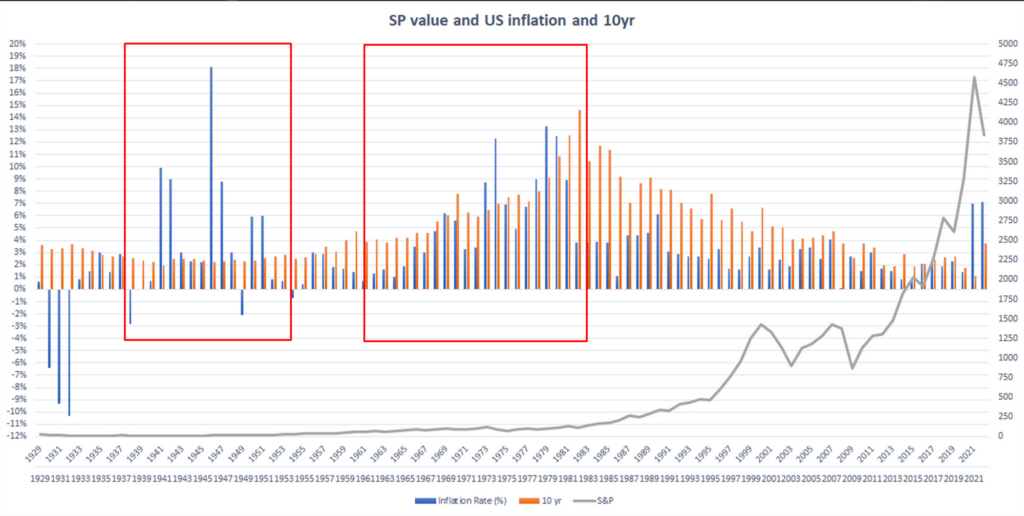

Using historical annual data from roughly the last 100 yrs, there's been two periods where rates and inflation rose in tandem.

Observations:

- Major spikes in inflation in 40s, interest rates are sideways/up

- Persistent rise in inflation and rates in 60s - 80s

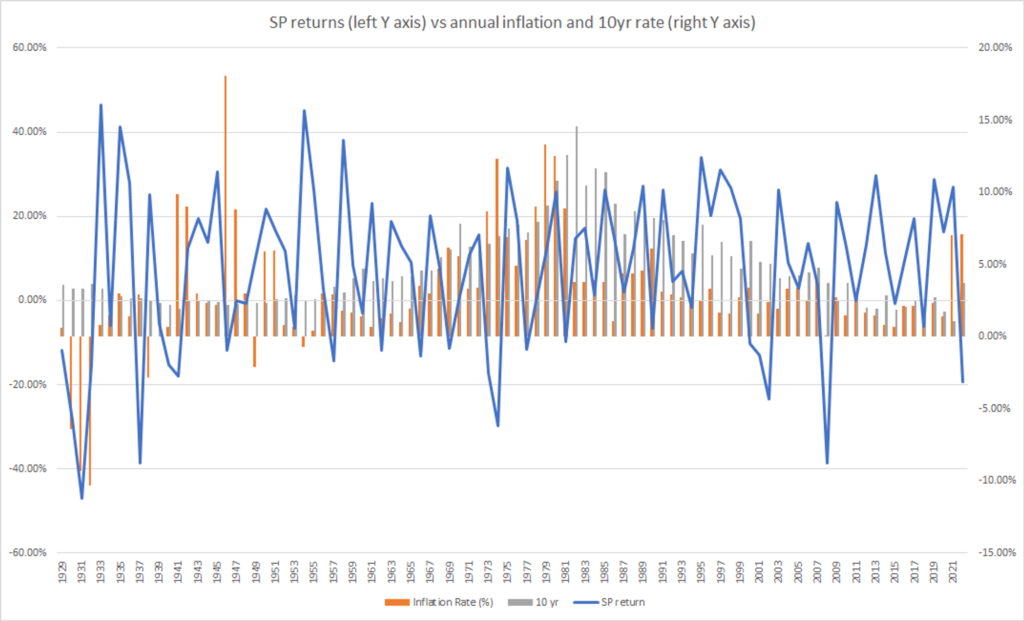

If we chart annual S&P returns against these inflation and rate figures it's kinda noisy, doesn't really tell us much about time to breakeven.

So I just eyeballed the charts in these timeframes to see when the markets finished correcting and how long it took to gain back what was lost.

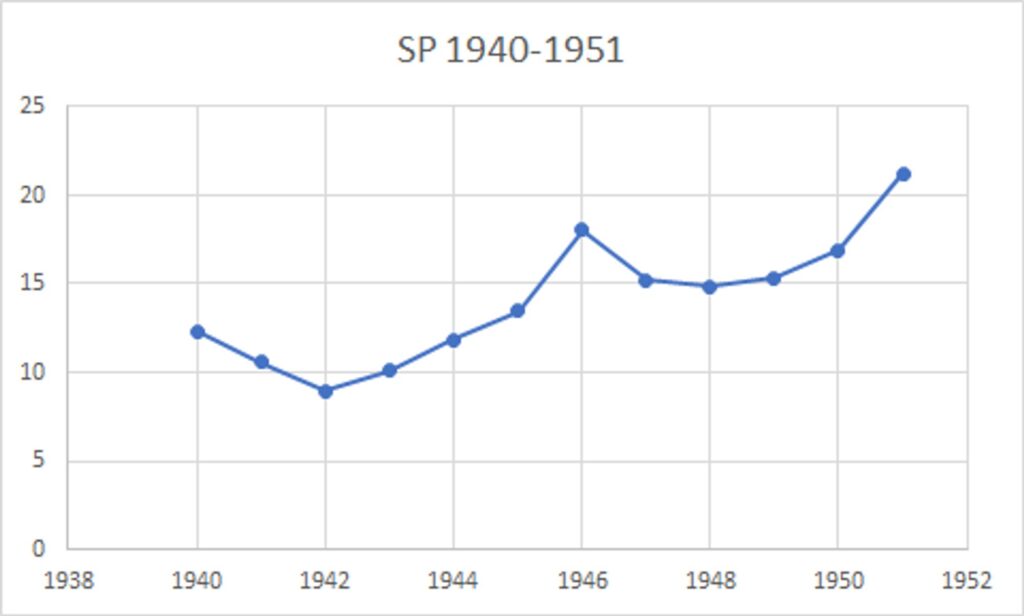

S&P in the 1940s:

Observations:

- First decline from 1940-1942: recovered losses by 1944 (2 years after bottom)

- Second decline from 1946-1948: recovered losses by about mid 1950 (2.5 years after bottom)

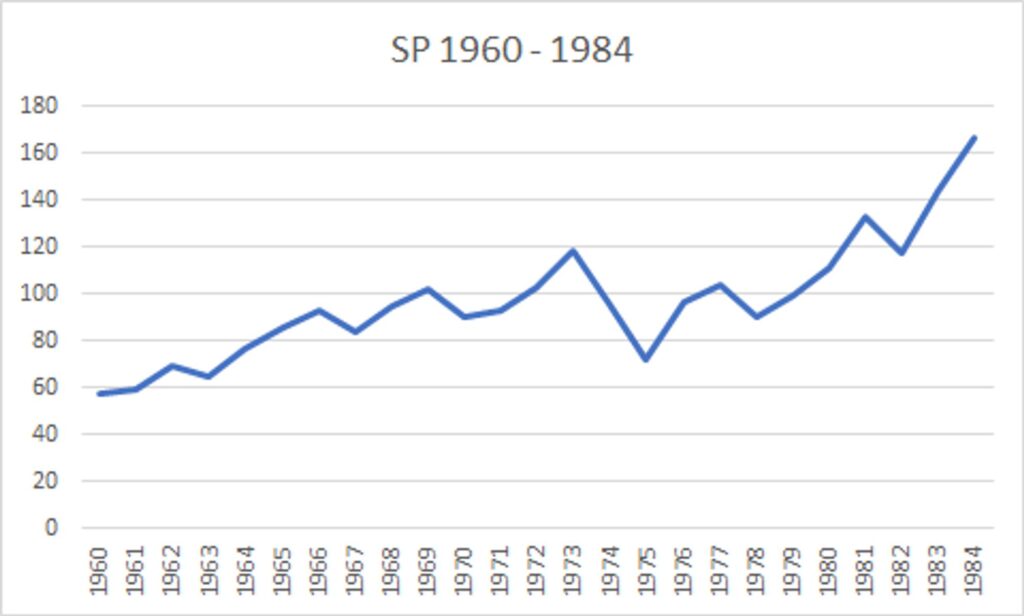

S&P in 1960s-80s:

Observations:

- Market is steadily up in 60s, any losses recovered next year in most cases

- 1970s known for high inflation + rising rates

- Worst stretch is from 1973-75

- Market recovers half of these losses by 1977 (2 years after bottom)

- Market recovers entirety of losses by 1981 (6 years after bottom)

History doesn’t repeat, but it often rhymes. These are some interesting historical patterns to keep in mind; it typically doesn't take that long for US markets to recover from crashes in this kind of environment.

Follow at @BackTheBunny

Check out another popular post --> Crypto Lending: DeFi Needs A Yield Curve

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.