It isn't a question of "if" but "when" for DeFi. The best way to illustrate DeFi’s inevitability and superiority is understanding what it does to financial supply chains. It disintermediates them. It can do this because blockchains provide entirely new forms of “hardness”.

The disintermediation of financial supply chains is integral to crypto itself. Think of bankers as javascript running really, really slowly and expensively. Glacially completing smart contract tasks. Their services are mostly programmable by a smart contract.

All the middle management, compliance team, HR department, the VP of diversity, and other forms of bureaucratic bloat that the old-economy company needs, DeFi does not. Good riddance.

All of these jobs impose a cost on the financial institution. That cost is embedded in the fees the bank/broker/etc pass along to you. You end up paying for every one of them in each transaction. Like KYC, for example.

It’s not all unnecessary bloat, many of these positions were needed to make up a functioning financial system. The point is they’re simply superfluous, overpriced, and inefficient compared to what we’re facilitating in DeFi. Why have these jobs and institutions previously been necessary for a functioning financial system? They must serve a purpose. That purpose is “hardness”.

Hardness means to make the future predictable in a way that allows you to take action predicated on that predictability. You can't make a financial or business decision without being sure other things will happen. Examples:

Atoms-based hardness: gold

Only a certain amount is mined yearly and the total amount is finite. It can’t be counterfeited. This atoms (physical) hardness is partly why we value it. You can be highly confident a counterfeiter won't flood the market, etc.

Institutional-based hardness: governments and regulations.

They provide laws and enforce rules. This allows you to transact with confidence about the future. Take contract law: you and I sign a contract saying I’ll provide a service and you’ll pay me X for it. You’re now reasonably assured to get the service and I am to get paid. If one of us violates the terms, the courts will enforce it.

This is "hardness" in action.

You look at company earnings and trust the numbers aren’t fraudulent because GAAP/IFRS standards create accounting rules, and the state punishes those that lie about it. Hardness. You have confidence your wire transfer won’t be stolen by the bank because regulation forbids it. Credit where it's due: institutions provide hardness that let us make transactions, deals, and business work. They make the world more predictable and stable.

Government and legal systems provide institutional hardness. They facilitate a financial system that, while imperfect, by and large works. Blockchains and smart contracts are new instantiations of digital, code-based hardness. They'll render many forms of institutional hardness moot. Blockchain regulations and laws are encoded publicly and enforced automatically, objectively, and without any bumbling bureaucratic interpretation or delay. It’s regulated by math and enforced with code.

Blockchains adhere to consensus rules that provide confidence in them as financial substrates. They’re a new hardness for humanity. We've created a pioneering form of societal coordination without violence or the state; it's an incredible human feat. Without the hardness of blockchains and smart contracts we wouldn't be able to create this new financial world. This brilliant "hardness" concept comes from @0xstark and a piece called Atoms, Institutions, and Blockchains. I recommend it, will link at the end.

ON SUPPLY CHAINS

It's axiomatic the more entities you remove from a supply chain, the more value is retained by both parties. Every bank and government agency is part of the old financial supply chain. Their costs embedded in what you pay. Their hardness used to be critical.

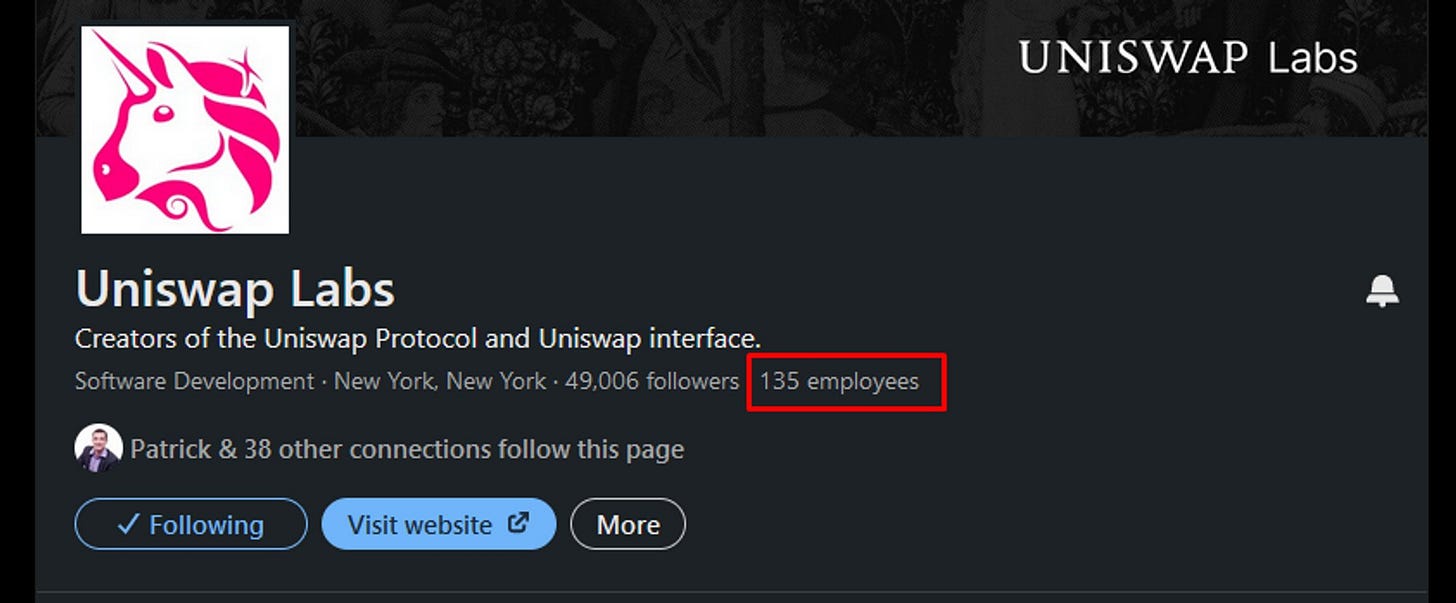

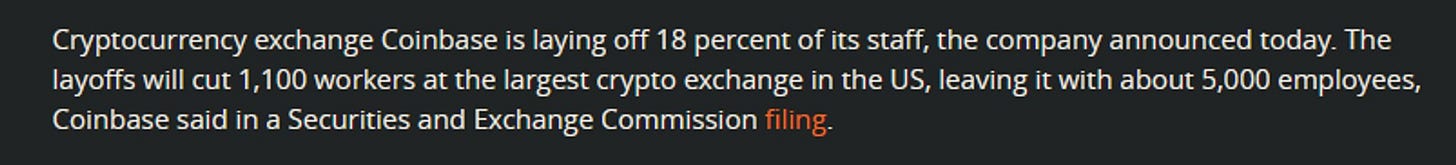

DeFi is a vastly superior business model. We can create businesses that rival TradFi ones with fractions of the operating cost and investment. It’s not even close. Uniswap employees: 135 Coinbase: 5,000… after laying off 1.1k.

>“Have you seen how much gas is on Ethereum! It’s more expensive than a broker! Superior economic model??”

Yes, well, our new financial paradigm isn’t perfect yet, is it. DeFi summer happened 3 years ago. Emphasis: we started building and using DeFi in earnest 3. years. ago (!)

People have no context when they lament how things aren’t perfect yet for this 3ish-year-old disruptive upheaval of the financial system. We’re creating new P2P networks for commerce and allowing people across the globe to transact freely in a way with no precedent. Come on devs it’s been 3 whole years, why isn’t DeFi perfect yet! Silly. Like a kid who starts whining “are we there yet” 30 minutes into an 8-hour road trip. No Timmy I’m sorry, it’s going to be a little longer.

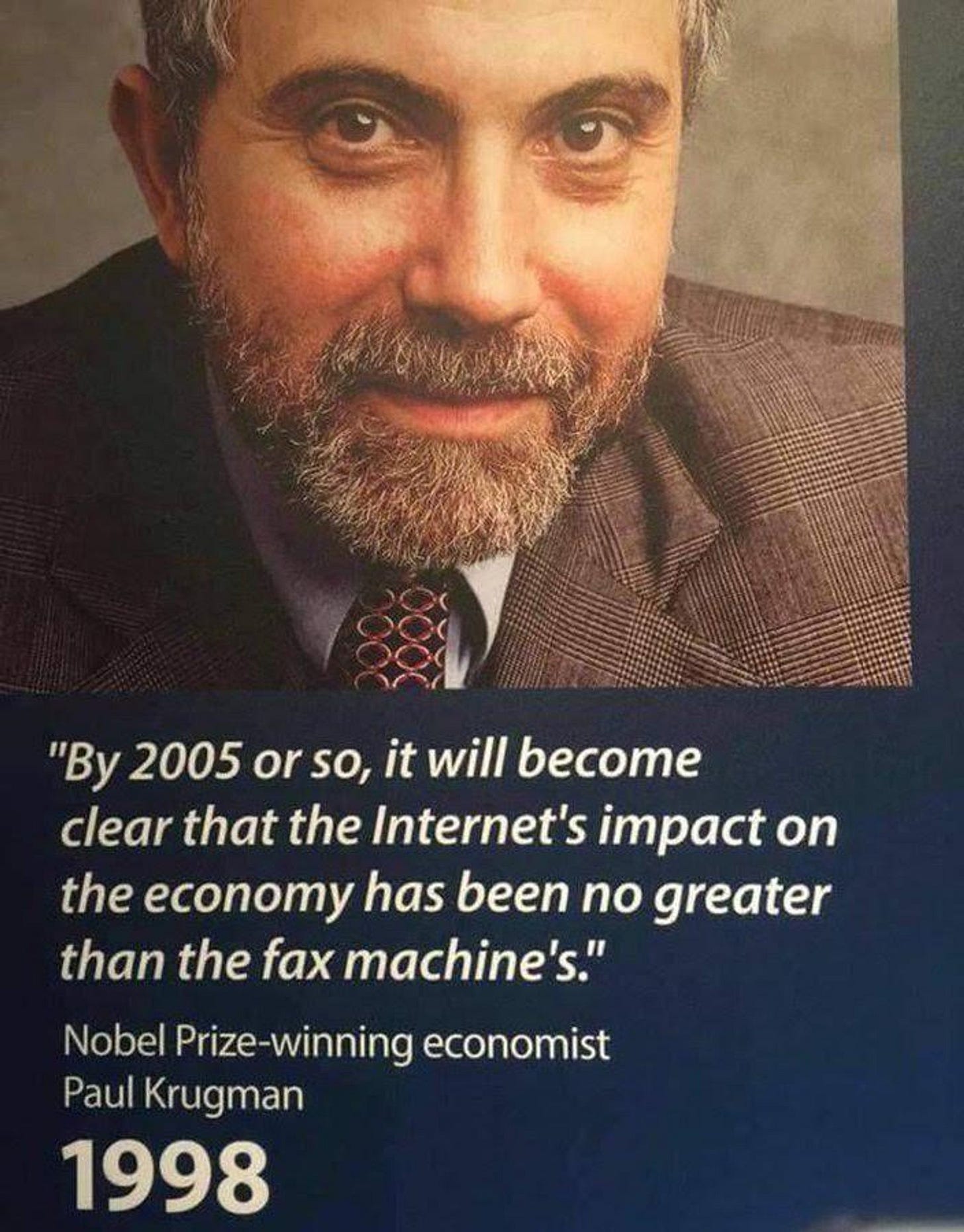

This criticism is tedious and acts like the internet was this perfect creation soon after it came out. For years it was painfully clunky with no obvious utility, and was mostly used for porn. Remember this quote? Do you want to sound like him?

Technologies follow a natural gestation and adoption cycle. We're still in our infancy. You actually are early! I know it doesn’t feel that way because people don’t view things in Fourth Turning-style cycles, they view them with quarterly-earnings-esque myopia. Don’t be a Paul Krugman.

You shouldn't be surprised an infant cries. Criticizing it shows you don’t understand what he is or will become. He can’t do much yet. He kind of sucks and is inefficient. “What kind of person is this? He can’t talk and shits his pants constantly! Throw him out he’s no good.” This is the same energy I hear when I see DeFi criticisms with PEPE coin infatuation and monkey pictures used as a fallacy of composition to smear our entire industry. Infants grow up. YOU ARE VERY EARLY.

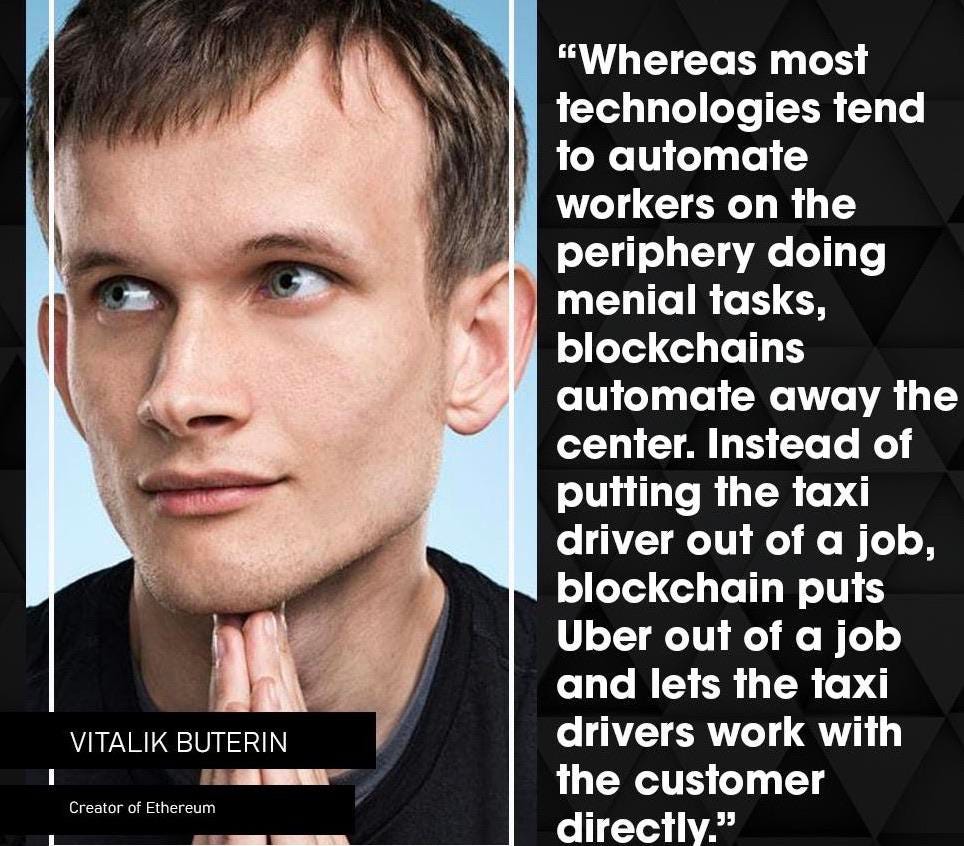

To quote the king: technology tends to automate workers at the periphery, but blockchains automate the center. Entities formerly required for communication and commerce are no longer necessary with blockchains. Uber is just a middleman, it's the driver I want to speak to.

Without that middleman cut, this means costs for both users and onchain businesses will be much lower compared to their old-economy counterparts. DeFi will facilitate financial services in places previously not economically viable. A business becomes viable when the capex to get it running and opex to maintain it goes from $40M to $4M. You can create a DeFi app with a handful of devs, try standing up an old-economy company that way. Uniswap vs Coinbase. Who is going to have better margins at scale?

If the ROI is there, investment will be made. DeFi is an unalloyed good for everyone and especially underserved populations, as a previously uneconomic investment now may have a positive NPV. DeFi facilitates commerce more cheaply and with improved hardness than the financial system that came before us.

Please like and share if you enjoyed!