I realize from intelligent feedback to Part 1 and my other Fed threads on @BackTheBunny that it’s important to provide a preface for the motivation behind this series.

The objective of this series and a huge point of contention with me is who gets the blame for the debasement of the dollar.

Recognize where power exists: become a Fed disrespecter.

The Fed: Part Zero

People fixated on the Fed are conflating fiscal and monetary policy, then acting like both are the domain of the Fed. They're not. They are very different things.

The Fed controls monetary policy. Congress/parliament controls fiscal policy.

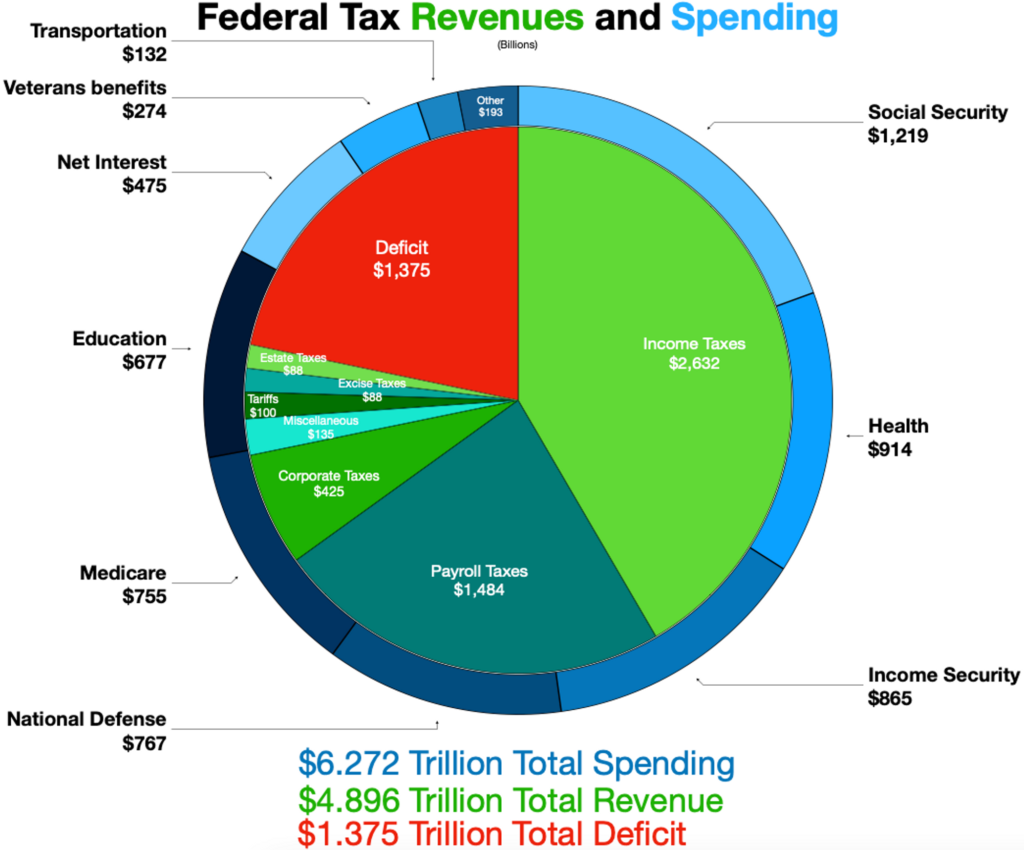

Fiscal is the guys running the deficits, creating the bloated spending budgets, then running more deficits. This is genuine money printing.

There is categorically a distinction between fiscal and monetary policy; they’re often conflated, and then lazily attributed to the Fed. What I’ve seen in rejoinders to my arguments is a smuggling in of fiscal into the conversation, conflating fiscal and monetary as one, then acting like the Fed is responsible for both. It's not.

Congress and the Fed are separate entities and act on different incentives and info.

Congress makes the laws for banks. Congress creates the budget for government spending. Congress is the one deficit spending, creating massive debt for the US. The national debt is now $31.5T, and the annual interest cost on that debt is $475B. That is roughly as much as the other top-5 military budgets (China, India, UK, Russia) in the world spend… COMBINED.

I bet you weren’t aware of that interest expense and its magnitude. But I bet you knew the Fed did a bajillion bond backflips and how big its balance sheet is. Sad!

Deficit spending means debt is issued (Treasurys) to fund the government. THAT is money printing. That is FISCAL POLICY. THE FED DOES NOT DO THIS.

Have you ever heard any investor really focus that much on budgets and deficit spending? Does it get much attention from DeFi or TradFi investors? Some will comment on it from time to time, but it’s mostly an afterthought.

How about when the Fed tells you it’s swapping bonds around and plays with the M2 chart? You work yourselves into a frenzy that makes a kicked hornets nest look tame.

My issue is you don’t look at the arsonist pouring gas in the background, just the scantily dressed girl in front of him doing somersaults who really really wants you to pay attention to her. AND you think she's a goddess who can do magic.

> “Ok, fine the Fed isn’t fiscal policy and fiscal is the problem, but the Fed is an enabler of larger deficits..." > "This QE bond swapping is basically monetizing the debt with extra steps. Fed lets the actual money printers (fiscal) keep abusing things. Enabler!”

This isn’t the counterpoint you think it is. In fact I’m glad you’re coming around to my side, because that’s what this statement implicitly entails.

You're admitting that fiscal is the criminal here, and the Fed is just one of the criminal’s weapons. Yes. Does the gun deserve attention for the robbery though?

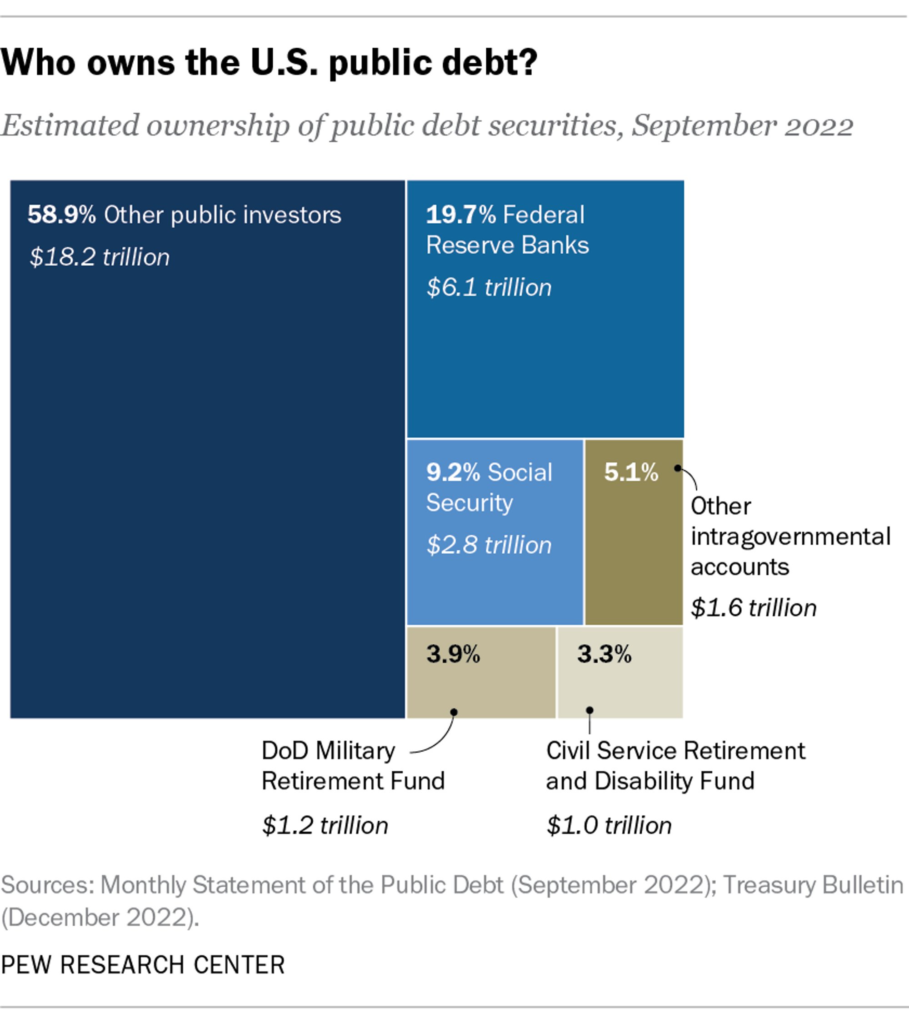

Also, let’s contextualize this “enablement”… the Fed holds about 20% of US debt. A lot, yes, but if the Fed didn’t own this our problems would be basically the same.

This 20% isn’t the reason why USD is a shitcoin and government spending is an obscenity.

The Fed is a fairly simple instrument that can basically only set a range for overnight bank lending rates and swap bonds around. Claiming the Fed is monetizing the debt with extra steps concedes it's at best a circuitous enabler of fiscal, and fiscal is actually the problem. Yes.

Become a Fed disrespecter.

These statements are very different:

> “The Fed is money printing!”

> “Well when the Fed does bond swapping, the downstream effects can enable abusive fiscal deficit spending.”

One of those is accurate and much less headline catching. Why is the truth always so unsexy.

Yes, the second point is correct. The distal vs proximate cause of the dollar debasement is starting to hit home, but there’s this near-religious obsession with the wrong institution, the gun and not the criminal. Because you think the Fed is basically God. Dollar Jesus.

I want you to recognize and revile the true distal-cause culprit, and assign him the blame, and credit, he deserves. Not his feckless proximate-esque court jester that does a song and dance that gets everyone’s attention. Become a Fed disrespecter.

I am a Fed disrespecter. Everyone that attribute all this omnipotence and money supremacy to monetary policy are Fed respecters. You respect this institution, you think it’s incredibly powerful and basically responsible for all the world’s economic woes. You may hate it, but you do respect it.

You fixate on at best a proximate-cause circus rather than the distal-cause mafia. Subscribing to Jay Powell’s OnlyFans, and showering him with the attention and admiration he so desperately wants you to give him. I hereby assert that I am more based than you in my Fed disrespect.

Stop being a Fed simp. Stop fetishizing this institution.

When you give something all your attention, you unknowingly legitimize it and reinforce its psychological games. You hate the Fed? Good, me too. So start disregarding it, not worshiping it.

> “Fine, monetary and fiscal policy are different. The Fed is at best a gun for the criminal. But behind the scenes they coordinate and it might as well be one thing.”

Despite the legal and very clear separation between these two institutions, I do get your point. FOMC members and congressmen have a lot of offline chats. I get it. I don’t disagree. Though that political coordination is likely not as clean as you make it out.

Have you seen how Congress operates? There’s only ever a slim majority in either direction, and it’s almost impossible to get a consensus or agreement on policy out of them for anything. This coordination is not as coordinated as it’s made out to be.

You think Congress is a partisan mess that can’t get much done (true) but it somehow gets it act together and agrees on what monetary policy should be for the entire country?

But yes, we’ll agree the Fed is influenced by Congress and sometimes politicized. I see these pictures too you know.

I bet you know who the guy on the left is, and I bet you don’t know who the guys to the right of him are. Or you’re kinda “meh” about them, no real feelings. But you have vehemently strong opinions about the one on the left. And he once wielded the hammer of Thor!

The guy on the left is a lackey for the other guys. My anger lies in that you are angry at the hitman for things only the mob boss can do. The Wizard of Oz institution gets all the focus and credit for things it can't do. And the real culprit gets by with little fanfare.

This series is controversial and I don’t expect it to sway those on the neoliberal, state-friendly left, convinced “the Fed is all powerful, that’s a good thing”.

Nor the ZeroHedge Austrian-crypto right, equally convinced “the Fed is all powerful, that’s a bad thing”.

(sorta a false dichotomy, mostly true tho)

I hope this speaks to an inquisitive middle that's open to genuine first-principles analysis on the topic of Fed power.

My goal: move the Overton Window and make Fed mocking a thing. Stop hyperventilating when the red herring entity and its priests want you to give it attention. Stop wasting mental resources if it swaps bonds around or changes ranges for overnight bank lending rates (the Fed doesn't control interest rates, there will be a post on this).

Start being properly concerned with the real money printers and dollar debasers: fiscal policy.

Please join me in becoming a Fed disrespecter. Part 2 coming soon.

Follow at @BackTheBunny

Check out another popular post --> Crypto and the Misuse of “Intrinsic Value”

interesting article .

This is a thought-provoking and informative series that distinguishes between fiscal and monetary policy and challenges the common assumption that the Federal Reserve is solely responsible for the debasement of the dollar.