Remember the Silicon Valley Bank crisis? Remember the Fed’s BTFP faculty that was purportedly “printing” $300B and the hysteria that ensued? Balaji said bitcoin would go to $1M within 90 days? I ‘member.

I posted this and this back in March and April 2023, during the peak of the SVB-led, Fed-induced delirium, saying the histrionics of Arthur Hayes, Balaji, and every macro pundit was wrong. What they were promoting was misinformation (unintentionally, but still) about what the Fed does and what “money printing” actually means. The thoughts and commentary you’re about to read here were shared in the midst of the panic from me, this isn’t a ‘hindsight is 2020’ thing. You can check the receipts in the links.

Nearly one year has passed since then. Inflation has continued to trend down. There was no crisis or huge flush of “liquidity”. This post is not a victory lap, it’s intended to document and reinforce how Fed worship is consistently wrong, yet always en vogue. When the Chicken Littles keep promoting the wrong things it needs to be noticed. I don’t know how else I’m going to drive this Fed stuff home.

Emphasis: every single bank alive is structurally insolvent. You could crush JP Morgan right now if everyone asked for their money back. None of these banking issues are new. This structural insolvency is integral to the very nature of banking. This is why Held To Maturity accounts exist. It’s because every time rates go up, banks are wiped out on paper. Insolvent. What’s surprising is this was surprising.

The Fed is designed to be a backstop for banking stuff like this. In fact it’s one of the few useful things it does!

SVB Backstory: What Caused This? And What’s the BTFP?

Dollars (deposits) are given to banks. This is USD that already exists. Banks invest this money into bonds and other instruments. Because rates rose (due to inflation, it had nothing to do with the Fed, you can read The Fed Part 5 for a thorough deconstruction) those investments lost mark-to-market value.

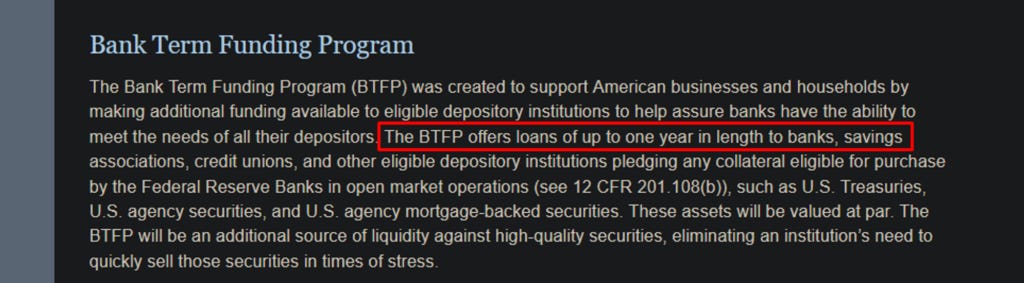

The deposits are now trapped until the bonds reach maturity, because even though the MTM bond prices are down, when they come to term they’ll repay the full principal. So the money is not gone, it’s trapped. I referred to them as “purgatory dollars” back in March 2023. The Fed, through BTFP, provided loans against those bonds at par so banks could access dollars for customer withdrawals. The BTFP loans last up to a year and then are repaid, or the Fed could just keep the collateral and receive the full principal at maturity. Either way the Fed gets its loan back.

That’s what the Fed’s BTFP is (Bank Term Funding Program). It is nothing more than factoring loans for dollars that already existed. At the time it was for around $300B.

"What about the time value of money? $300B now is worth more than it is later."

Yes. True. But to emphasize: you’re pivoting from “money printing omg” to “ok yes it’s a loan and time-value makes the cost a little different”.

Much saner framing, isn’t it.

The reasonable way to panic (if there is such a thing) wasn’t to convulse like this 1-year BTFP loan is "printing". It's to act like the time value of money (TVM) is so gargantuan that it de facto acts like printing.

So let's see how much this TVM really is.

Purgatory Dollars

(There’s some repitition here and it’s important this sink in)

Those SVB deposits were "trapped" in purgatory. Because of how bank assets lost value as rates rose, the deposits that were given to them are in purgatory until the bonds they hold mature and return their principal. When those underwater USTs mature, the money returns. Unequivocally.

Those bonds were never meant to be sold or valued MTM. Held-to-maturity accounting exists because banking could not exist valuing everything real time. This is not new. This is not surprising. ZeroHedge willfilly chooses to not understand this.

The Fed provided deposit access for stability, and when those purgatory dollars come back to life, the Fed will take them (the bank will probably repay the loan well before then).

The NET amount of dollars in existence is the SAME from this. You could certainly say this avoided a deflationary event. But that is dramatically different than saying this is causing an inflationary wave, dumping liquidity everywhere, and “printing money”.

Reasonable framing doesn’t get the clicks though.

Factoring Loans and the BTFP

Think of the Treasurys the banks own as an accounts receivable, guaranteed by the US government. These accounts-receivable dollars are coming back to life, so we're dealing with the concept of time, not the concept of existence.

Providing a loan against incoming future money is called a factoring loan in the business world, it’s done all the time. Businesses do this by borrowing against their accounts receivables, invoices, or money they’re owed but haven't been paid yet.

They know they have dollars coming in the future but they need cash now, so they borrow against this incoming money, pay interest on it, then when the accounts receivable is paid, pay off the loan.

See the BTFP similarities?

How many foment panic over accounts-receivable loans?

Time Value Of Money

TVM is the backbone for how basically all financial assets are valued.

If I’m giving you a loan for USD that already exists and you were 100% already getting back in the future, we’re dealing with a time value of money argument not a money printing one.

“Money printing” means these dollars are new, additive to the total dollar supply, and don't have to be paid back. That is not what happened. These USD deposits already existed. These loaned dollars will die within a year.

So how do we measure the TVM angle?

The BTFP loans are only for up to 1 year, but I’ll do you one further and pretend like they may be for 8 years. Let’s pretend the BTFP is 8x longer than advertised and see what that means for actual dollar creation! Surely this will be juicy. Surely.

Important: what exactly is the ‘time value of money’?

Money now is worth more than money later because when it’s in your hands you can do productive things with it that allows you to generate more money from that money. So the more you have to wait for money, the less valuable it becomes in present terms, as you are missing out on the utility that money could be bringing you today. That’s what “discounting” means in finance parlance.

A common way to calculate the discount is via the ‘risk-free rate’ (RFR), typically the US 10-year Treasury. AKA the discount rate. For this exercise, the TVM calculation I’ve made assumes everyone takes their BTFP loans, invests in the 10-year UST, and compounds (a generous assumption).

So let’s see how much more money this $300B BTFP factoring loan will generate. The 10-year yield was about 3.5% when I originally wrote this. If you think the discount rate should be different you can just tweak the 'r' value.

So at the end of year one, the TVM additive amount of USD in the world is $10.5B more. It takes a year to create that extra capital. 2 years from now we’re looking at $21.4B more USD, etc.

And now let’s pretend we were wantonly lied to and these loans are allowed to remain outstanding for 8 years… $95B more is made. After 8 years! I think I’m sufficiently steel-manning the other side here. BTFP loans only last 1 year then are repaid. So if we’re being sober, undramatic people whose entire financial personality isn’t what Jerome Powell ate for breakfast that day, that means the 1-year TVM calculation is what applies… around $10.5B in new dollars around Q1 2024.

Oh btw the banks own interest on BTFP loans! I’m not even factoring this in! So it’s actually less than this. I’m intentionally trying to be generous here to drive home a point.

My investment thesis from this: BTC to $1M within 3 months. Right Balaji?

Even if we’re egregiously misled for 8 years, we’re talking about roughly $95B more USD in the world. In EIGHT YEARS. I think fiscal policy sent this much to Ukraine in Q2 2023 alone, and probably another $1B to install senior-friendly bathtubs in the White House.

But that’s not exciting. Worshiping at the altar of the Fed is far more exhilarating.

I’ll be publishing more from my Fed Series to this blog soon (they’ve been on twitter for a while now).

Thank you for reading and sharing. I’m emphatic and impassioned in this series only because I care.

Follow at @BackTheBunny