Fed control is a mass delusion. Recognizing it will be both uncomfortable and liberating. You’ve never inspected their claims, have you? Let's do that.

Thus far, this series has focused on the Fed’s asset-swapping programs, namely QE and the Fed’s balance sheet. None of them actually create new assets, they’re simply optics games that distort M2 charts and bank balance sheets. They are operational distortions that, once understood properly, expose them for the Pavlovian game they are.

Read Part Zero, 1, 2, and 3 after this to understand why (linked at end).

I’d now like to now go after the granddaddy of Fed claims: we control interest rates.

No sorry, no you don’t.

"The price of money, we change it at whim.” says the FOMC. They gather around and observe some lagging indicators and then tell you they've decided what money costs.

You obey and accept Fed power without a second thought. Yes sir, no sir, thank you may I have another sir. Then they hold a series of interviews and press conferences trumpeting their claims. They tell you to jump, and you leap as high as you possibly can. Why do you do this?

IMPORTANT: An institution that *reacts* off of *lagging* information...

DEFINITIONALLY DOES NOT LEAD ANYTHING.

You’d laugh at anyone that told you he drives via the rearview mirror and also dictates traffic by yelling at it. Don’t make exceptions to this. You have never critically questioned Fed power. Because absolutely no one does. Not *should* they do it, but *CAN* they do it. You’re told the omnipotent magical institution did some magic, and then look to advocates of the omnipotent magical institution to confirm the claims.

You have the same beliefs about the Fed as BlackRock, The Economist, the State, every Fed employee, Davos, CNBC, etc.. You get ALL of your information about the church from its clergymen. And you find this credible? Why do you accept this when you’d reject it anywhere else?

Every single money manager, normie, pundit, retail trader, hedge fund analyst, and everything in between accepts it uncritically. You’re told “don’t fight the Fed” just like a Catholic tells you “don’t question God”.

Let's review the church's divine monetary grace together.

---

WHAT ACTUALLY HAPPENS WHEN INTEREST RATES ARE “CHANGED”

What exactly goes down when the Fed tells you it’s raising or lowering interest rates? How is it implemented and enforced? Let’s get really specific.

The Fed provides a target range for the Federal Funds Rate (FFR) when it announces rate changes. The Fed doesn’t actually set the FFR; it’s an overnight market lending rate set by supply/demand in the interbank lending market.

The FFR is a rate for overnight reserve borrowing between banks. The Fed provides a desired range for the FFR, and then encourages it with economic incentives. It holds a series of extremely flamboyant press conferences when it does this.

Please sear this into your mind: when the Fed “changes interest rates” it is quite literally giving a range it would like an overnight bank lending rate to be.

----

HOW IS THE FFR ENFORCED?

The FOMC holds a press conference and announces… an interest rate change. Everyone is tripping over themselves, CNBC’s next 372 guests will be discussing it. Call your mother and tell your friends: overnight money market rates have been altered.

As mentioned, the Fed doesn’t actually set the FFR, it’s a market rate. So how is the Fed's target range enforced? Economic incentives. All of them straightforward. Here’s how they do it:

- The IORB (interest on reserve balances): The IORB is set by the Fed and it's what banks earn on their reserves at the Fed. Think of it like the bank’s savings account and the interest rate they get. The IORB plays a big role in how the Fed gets the FFR it wants.

- Open Market Operations: The Fed toys with supply of repo collateral by buying and selling USTs. Small tangent: This is all QE/QT does. It changes the composition of bank balance sheets and makes everyone think a liquidity happened because reserves were shuffled around. Imagine if your bank moved money in your savings account to checking, does the world have more money now? When “QT” happens it moves it from checking to savings. Liquidity! All still held at the Fed. Pavlovian games.

- The Discount Window/Rate (DW): The DW is the rate banks pay to borrow directly from the Fed; it’s the lending rate the Fed actually sets. There’s stigma in the banking world associated with using the DW, because it implies trouble. So it’s not used as often as other tools. There's such stigma that the reporting of who used the DW operates on a 2-year delay to avoid shaming (really). The DW is set higher than the FFR to discourage its use unless necessary. You can think of it like a ceiling of sorts.

- Reserve Requirements: The Fed can dictate the reserves banks must hold against their loans/deposits. While this does impact repo behavior, it’s not a tool they modify very often.

- Overnight Reverse Repurchase Agreements, aka “reverse repo” (RRP): RRPs remove reserves from the system. The bank lends the Fed money, and gets securities to collateralize the loan, plus interest. If the FFR dips too low, you can use the RRP to get a better rate on your cash.

- The Standing Repo Facility (SRF): created 6/2021, it's the inverse of the RPP. Instead of the bank lending cash to the Fed, it lends Treasurys, receives cash, and pays the Fed interest. If the FFR goes out of range, you can access a repo loan from the Fed at a better rate.

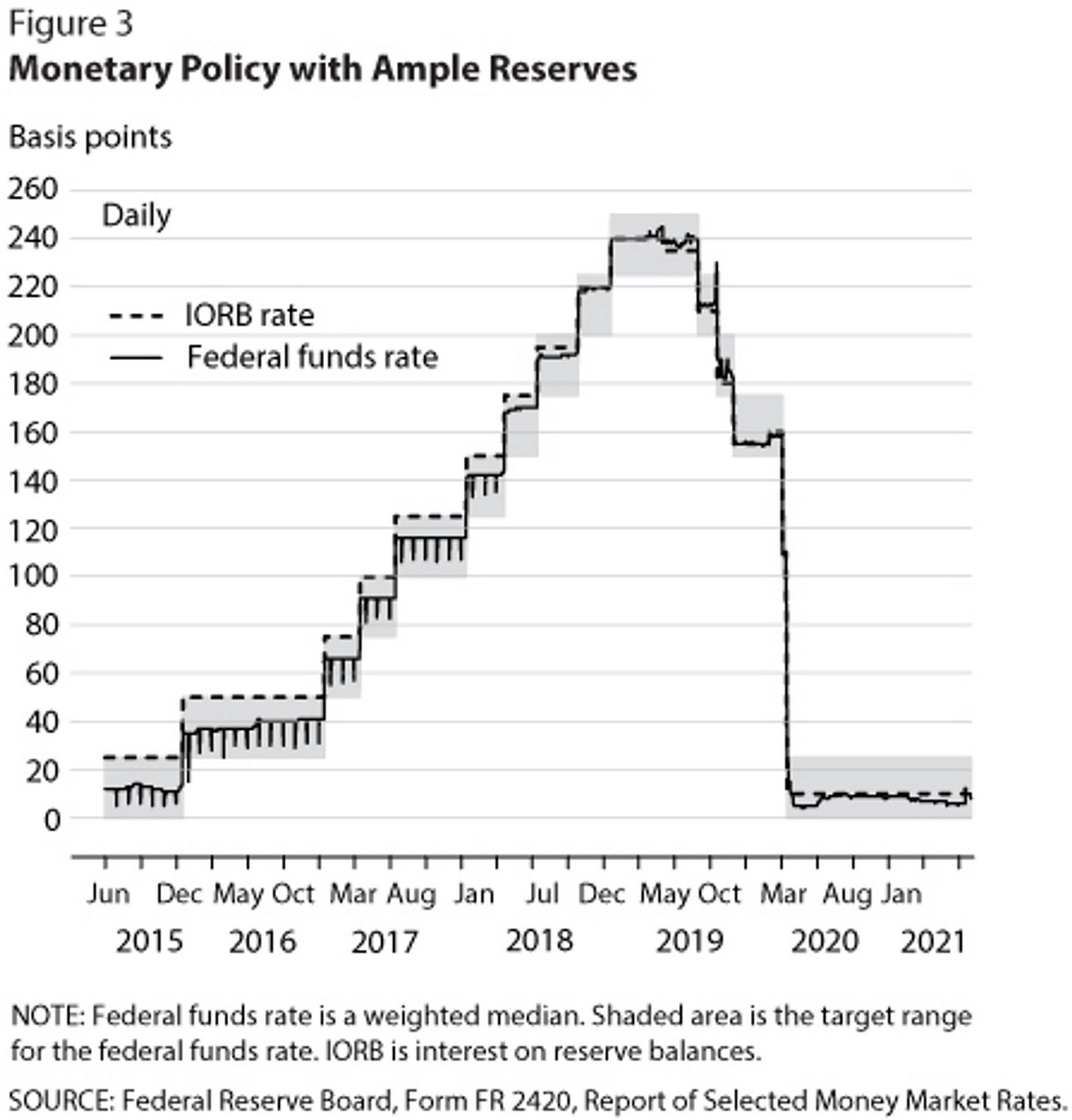

Important: I don’t doubt the Fed’s ability to control the FFR. It clearly can. The economic incentives keep it in check.

ADDENDUM: if I missed a Fed faculty used to corral the FFR… neat. It's always some version of “provide a service so it’s economically not rational for the FFR to stay out of range”. It doesn’t change the functional accuracy of this exposition.

---

WHY DOES AN OVERNIGHT MONEY MARKET RATE GET EVERYONE SO EXCITED?

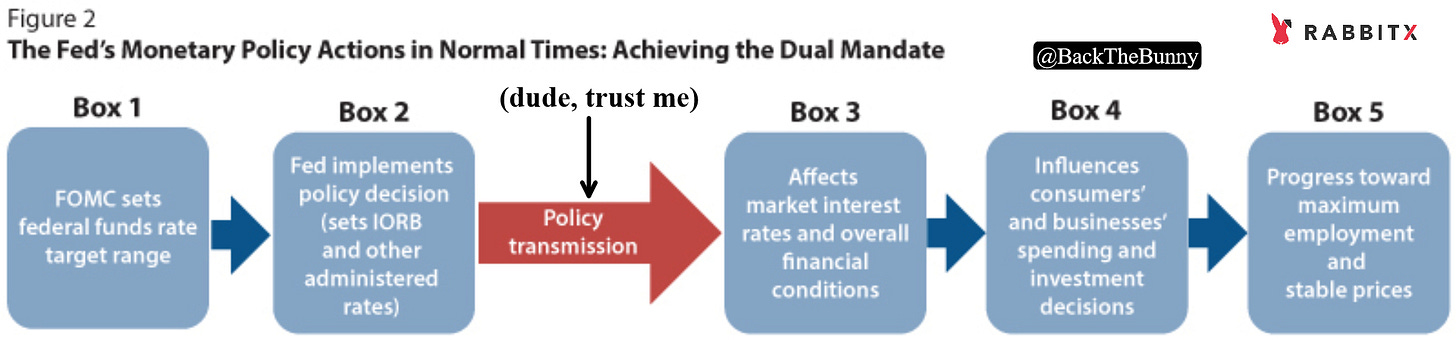

Interesting, isn't it? Here’s how the Fed thinks the FFR interest-rate process works its magic. The below is literally from the Fed. Observe the sheer power of "policy transmission"

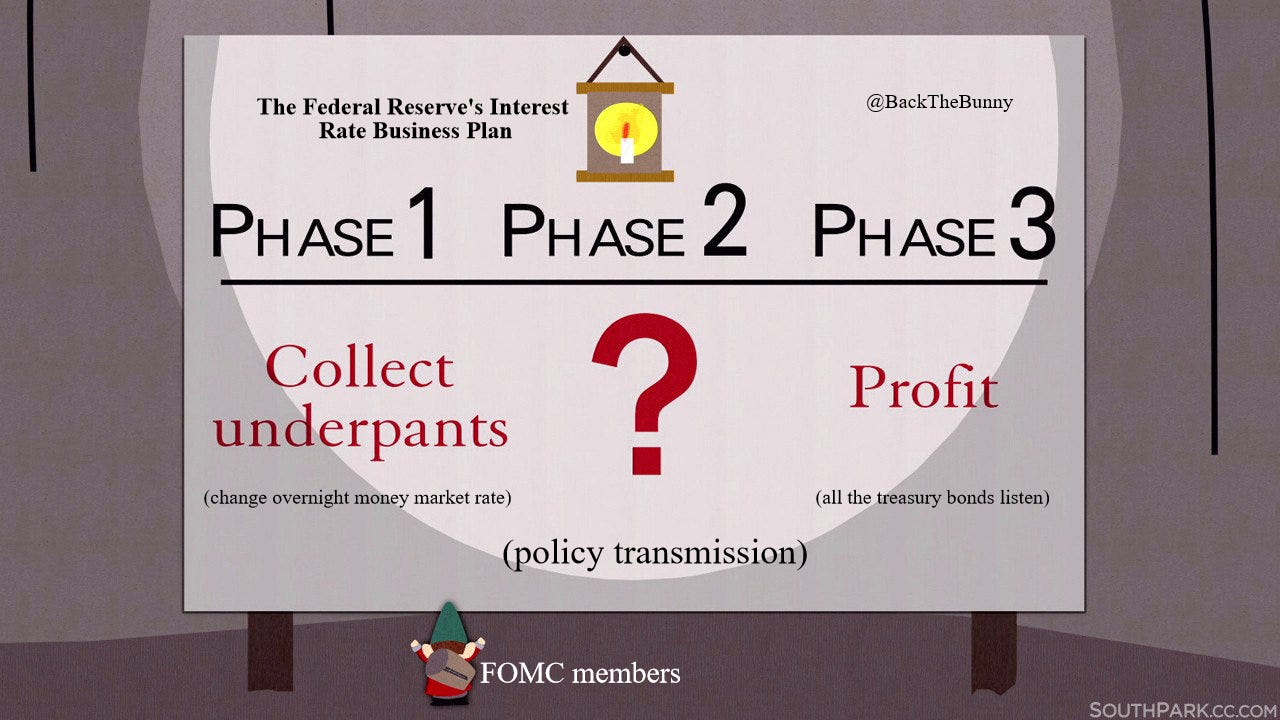

Neoliberal economists (Keynesians) have well-known disdain for “trickle down economics”. But the rationale for how the FFR changes the cost of money for the deepest, most-sophisticated markets in the world follows the same reasoning. Introducing “trickle down interest rates”.

The official-yet-unofficial explanation for how the Fed controls the collective price of money: If the FFR changes, then the entirety of the most liquid, intelligent market in the world (Treasurys)….JUST LISTENS.

Related: remember this South Park episode? Step 1, step 2…. profit. Take this logic and dress it up with some academics and economic pseudoscience and there isn’t much difference here. “Policy transmission”.

---

WHY DID YOU EXPLAIN THIS IF YOUR THESIS IS THEY DON’T CONTROL RATES?

Because you need to see how the sausage is made to understand you’re not actually eating steak. There’s a lot of mechnical misinformation about the Fed out there that vastly overstates its abilities. Don’t let “dude, trust me” work when a US institution wants you to believe it’s all powerful. This mythic mystique seduces you into not asking questions.

You have strong opinions about what the Fed should do, but you have zero questions about *whether it can do those things at all*. I’m not asking you to agree with me, I’m imploring you to ***examine extraordinary claims critically***. That which can be asserted without evidence, can be dismissed without evidence.

Breaking this down demystifies the “dude, trust me” of Fed power. Once the aura has been shaken, you can start assessing it like you would anything else. Now let's dissect if "policy transmission" is as powerful as you've been told.

“If the Fed only changes the FFR, why does everyone obsesses over it? This rate must result in something else happening...?”

Yes. When Fed acolytes hyperventilate it’s not really because of the FFR, even though that’s all the FOMC does. The focus is (hopefully) on something else.

What everyone cares about is real life, boots-on-the-ground rates that people experience. The FFR is not what’s used for IRL financial activity. It’s not how hurdle rates for business and investment are determined.

---

THE US TREASURY MARKET VS THE FED: WHO DICTATES TO WHO

You’ve been provided no hard evidence the Fed controls the cost of money, but since my claims are iconoclastic I do require evidence. It’s inconsistent, but I understand. So let’s autistically examine what goes into UST rates.

The interest rate of greatest consequence is the 10-year UST (10yr). It’s a common reference for discount rates and the risk-free rate (RFR) for economic activity. However all USTs matter for interest rates we experience in real life.

When the UST 5yr, 7yr, 10yr, 30yr, etc. move, other interest rates of similar duration move too. A 30-year mortgage and other IRL rates you encounter are influenced by US Treasury bonds of roughly the same length.

This is why the UST curve matters. This is why the price of government debt can effect your car loan. USTs are considered ‘risk free’, and from a default standpoint that’s true. Say a 30yr UST has a 4% yield. Then your mortgage, which is riskier, should have a higher rate. This is called risk premium. This logic applies to corporate debt and bonds pretty much everywhere.

It’s these longer-dated bonds (5-30yr USTs) where the economic action is. The rates they offer act as a guide for the rates people and businesses experience. These bonds call the economic shots.

Here are some charts I put together to illustrate what actually dictates interest rates, and how the Fed tags along claiming credit for what's already happening. Remember: something that operates **reactively** off **lagging information** definitionally does not lead anything.

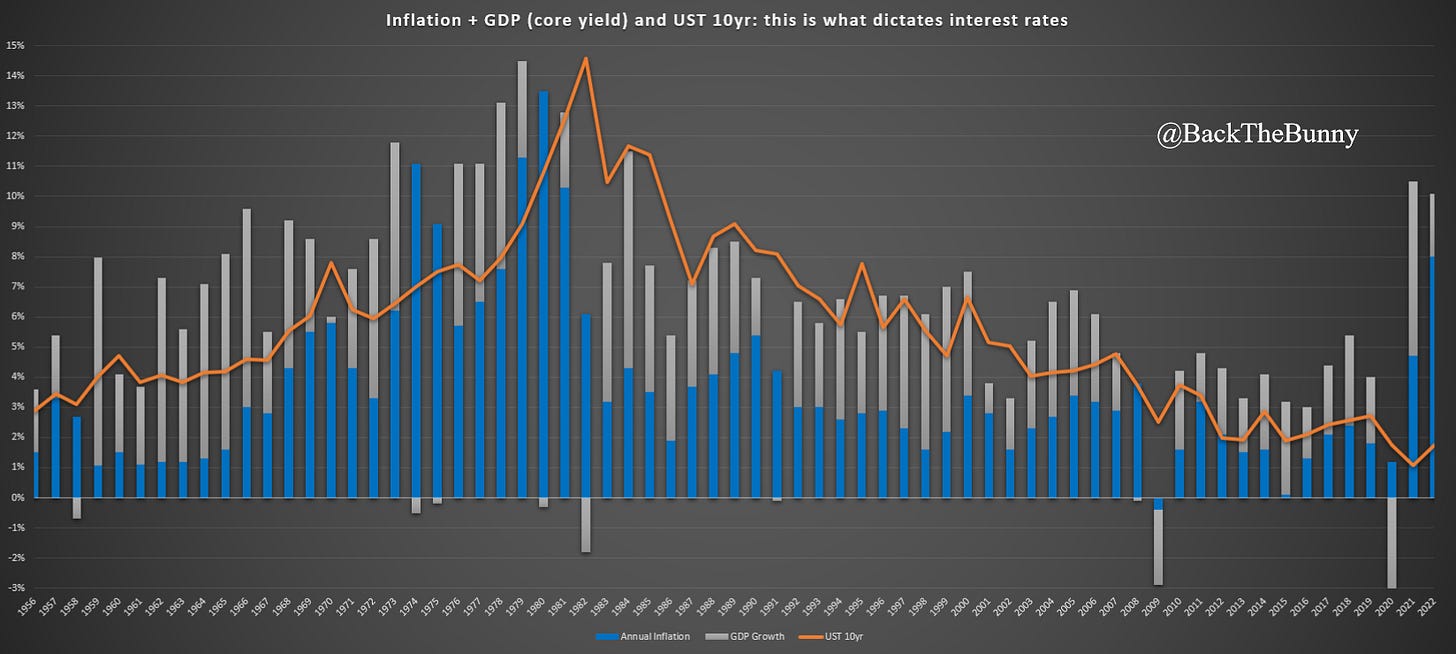

What informs interest rates? It’s inflation + GDP growth. That’s it. That’s the answer. Whatever the sum of those two things are informs nearly all of what rates are. Let’s see what this looks like historically.

What I’ve done is take annual inflation and GDP growth going back to 1956 and added the two together. We’ll call the rate produced by GDP + inflation the Core Yield (CY). Then I’ve taken the US 10yr and plotted it with the CY.

Observations: Looking at 1956 - 1980, a period of rising inflation, the CY consistently leads the 10yr higher. In periods of declining rates, the CY and 10yr we’re very closely aligned, almost in lockstep with each other. I see the CY leading the 10 yr in rising environments, and the 2 more closely tied in decreasing ones.

NOTICE: at the end of the chart how the CY shot up! I wonder what happened next?! Must have been a Fed decision! Like how a rooster “decides” it’s time for the sun to rise by crowing.

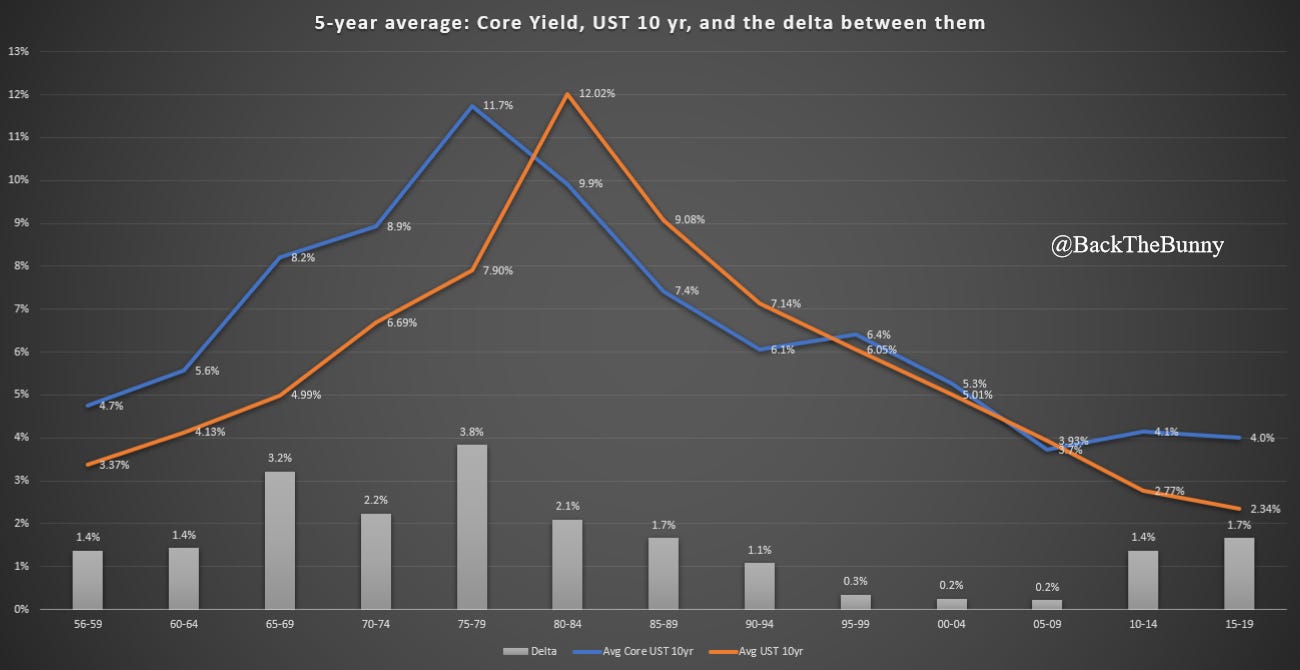

Now let’s smooth this out with 5-year averages of both and see if it looks any different.

Observations on the 5-year average of the CY and the 10yr going back to 1956: Same pattern of the CY leading in rising environments, and then tracking closely in declines. This isn't hard.

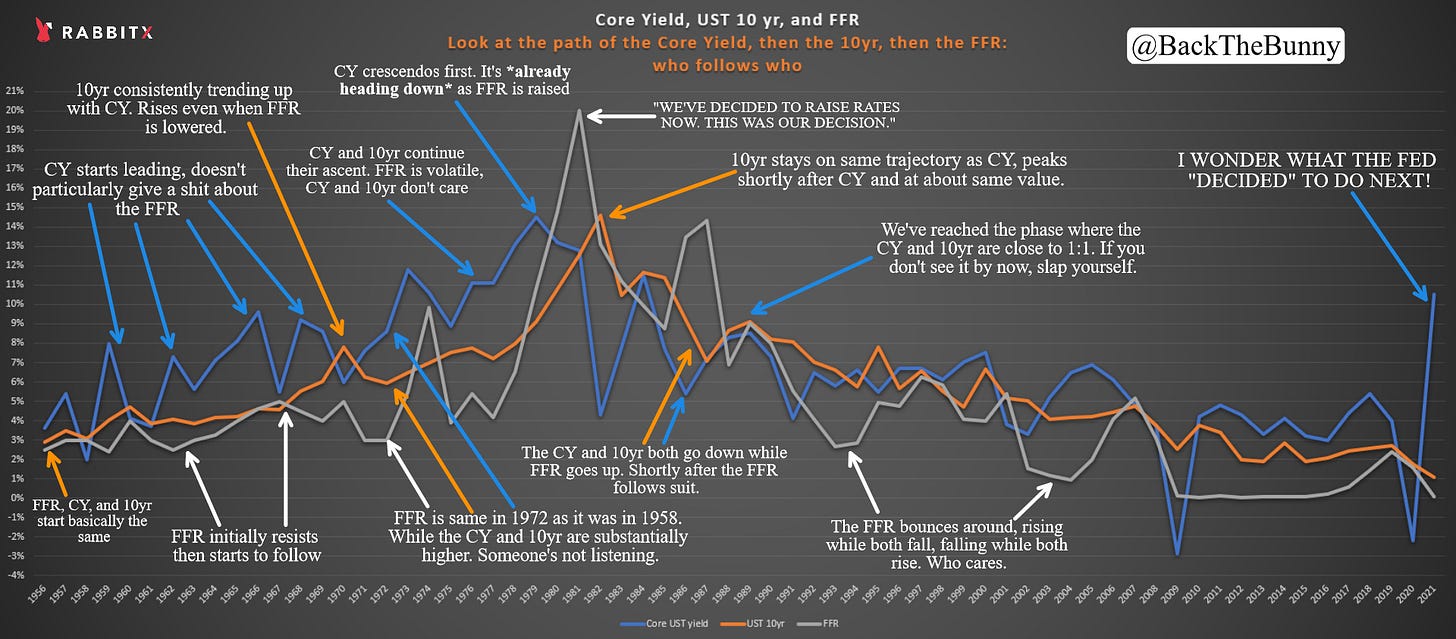

And now for the main chart. You just saw how interest rates encapsulate inflation + GDP. Now let’s add the FFR to the mix. Surely we should see the FFR leading since the Fed is directing things…?

This chart may seem overwhelming, but it’s just annotations. The data is simple. Start at the beginning, read each comment, and follow along. You’ve gotten this far, now complete your journey. Please remember while reading: something that lags does not lead.

That’s it. This doesn’t need some multivariate regression P value obfuscation to explain further. You can believe your lying eyes. The truth of how rates are derived is macroeconomic inputs that nobody controls.

Observation: isn't it odd how no one can predict rates, not even the Fed! How can this be if they control them? Smart guys like @balajis have the answer right in front of them. Even remarking how it’s weird the Fed can’t predict the thing they control! Yeah, about that...

I inculcate these points because this is how political misinformation is undone. The age of the internet allows for greater meritocracy and distribution of info. But credentialism still matters. I’m the only guy I know of saying this (in addition to Jeff Snider). What can I reasonably expect to accomplish?

The best I can hope for is you walking away thinking: “Well he did make sense, interest rates do seem to be macro inputs the Fed doesn’t control. But…. it’s too fringe. I can believe this quietly to myself but can’t admit it publicly.” Fine. I accept this. Until CNBC and everyone internalizes this reality, you can’t individually. So try and do this for me: stop saying “the Fed changed rates”. Begin by just slightly modifying your language, try “money market rates changed”.

Try it. It’s true, you’re not saying anything wrong, and the subtle tweak of language removes the undeserved reverence you give to this institution every time you credit it for something it cannot do. Language matters.

I very much appreciate you being open minded enough to read this far. Thank you for being a curious person. I'll put together various follow-ups, objection refutations, etc. in future posts I'm sure. Please subscribe and share!