“Commoditize your complement”: this is a business strategy worth being familiar with.

ChatGPT and LLMs just commoditized the complement of data: software.

This increases the value of data, but mainly drives value accrual to the new scarce complement: semiconductors.

Complementary products (CPs) are ones the need each other to be valuable. Many products have complements. With CPs, more of one means relative scarcity for the other. The more relative scarcity a product has the more value it typically accrues in the complementary relationship.

Examples:

- Cars and gasoline

- Operating systems and apps

- E-commerce platforms and payment processors

- Games and gaming hardware

Competition is enhanced for commoditized products. When a complement is commoditized, margins are reduced, stymieing R&D and differentiation. The word “moat” is often overused, but this can act as one. If your product’s complements are fungible ants, you become the Queen. The value accrues to you.

Google is a brilliant example of a company that tries to create a desert of profitability around it. Why do you think they build so many “free” neat apps? They want your data, yes. But they also want to neutralize the margins of adjacent businesses, so the value can accrue to them in digital product supply chains. More time online -> more data -> more search engine use.

Open source software is an interesting strategic commoditization angle. Here are more examples from an excellent piece by Gwern on the topic:

Here’s another killer complementary duo: data and software.

The original pairing for this was vastly in favor of software scarcity. As storage/memory became progressively cheaper, we defaulted to saving everything. The world became awash in data.

We’ve all heard some variation of the stat “95% of the world’s data was made in the last 6 years”. Whether it’s 93% or 96% or 4 or 8 years is irrelevant, suffice to say basically all of the world’s data has come into existence in the last 10ish years.

Software is a complement to data because it’s the tool you use to manage data. Data is a useless blob without software, and software has no real use without data. So a surfeit of data means data is comparatively commoditized vs software. If you’re a SaaS investor, you’re aware what this has meant for software company valuations and the gigaunicorns it’s created over this last decade.

Enter LLMs. LLMs are the lovechild of data and software. And they’re really really good at making more software.

ChatGPT, Bard, BingChat can all code. They’re not perfect, but only ~6 months in and they already turn a regular engineer into a 10x one. Give them another year and I’m pretty sure most software will be built by just describing what you want to the LLM.

That means the value of data will increase relative to software. But imo not by much, since the proliferation of more software means more data exhaust gets churned out: a flywheel that makes both more abundant. Maybe proprietary data sets get more valuable, but really I think the takeaway is that I’m more bearish software valuations than bullish data. Software will become more plentiful and commoditized.

So what’s the complement to them both that gets scarce in this relationship?

The scarcity play so far has been GPUs. Everyone knows about $NVDA. Buying GPUs as a pick-and-shovel play isn’t a new insight.

Ok but there are more to GPUs than Nvidia. And there is more to AI’s needs than GPUs. Semiconductor companies will collectively benefit as compute needs skyrocket.

What are the critical components of these AI engines that will soon accrue most of the value? Let’s see how a GPU works and then figure out the semiconductor supply chain.

HOW A GPU WORKS

Step 1: understanding the architecture

Step 2: memory

Step 3: task coordination

Step 4: Processing. How a tool for gaming is applied to AI:

Something that gets my attention: memory.

Which semiconductor companies have an emphasis on memory? Specifically VRAM for GPUs.

Semiconductor supply chains are quite possibly the most sophisticated and fragile in the world. Let’s see what they look like.

Step 1: Designing the chip

Step 2: Producing the Silicon Wafers

Step 3: Fabs. It doesn’t mention extreme ultraviolet lithography (EUV), which is what companies like ASML facilitate. It’s how we get processes as small as 5nm. The most bleeding-edge chips use EUV.

Step 4: Testing and Sorting

Step 5: Packaging and Assembly

Step 6: QA

Step 7: Distribution

Lots of potential places where value could accrue in the semiconductor and GPU-creation process. Here are more publicly traded semiconductor companies and their positions in the supply chain, and whether they have a relationship with $NVDA.

Should we just take the index fund approach and make our own little self-managed ETF? Probably. But let’s look at the performance of these companies and their stocks to see if we can spot possible supply-chain alpha. For fun.

Side note: just because it’s a good company doesn’t mean it’s a good stock. Eg Nvidia is obviously an amazing company, but its stock is up substantially and could underperform others in this list over the next 1-5 years.

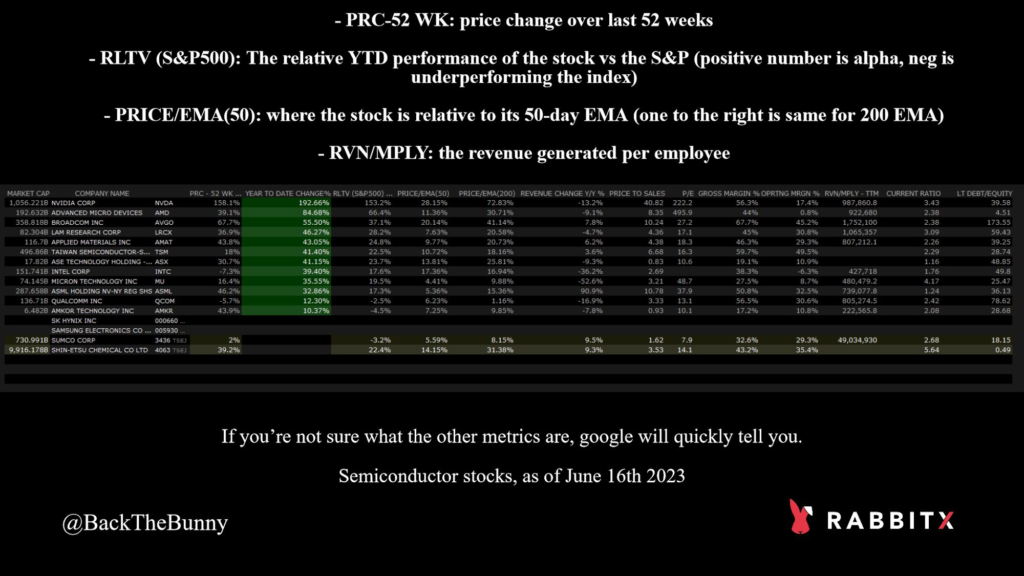

I gathered almost all the aforementioned semiconductor companies and sorted them by YTD performance. I’ve added many financial and valuation metrics so we can see relative performance and what companies seem to be more structurally sound. I don’t have market data for the Asian-listed co’s.

I’ve included an explanation for the metrics that aren’t self-explanatory in the graphic. It’s a lot to put in one graphic I know, but I couldn’t think of another way to show it that was intuitive.

Observations:

- $NVDA’s margins and rev growth don’t reflect the guidance from their massive earnings. They guided to 52% QoQ growth and a 70% gross margins. So current numbers undersell them. More details here.

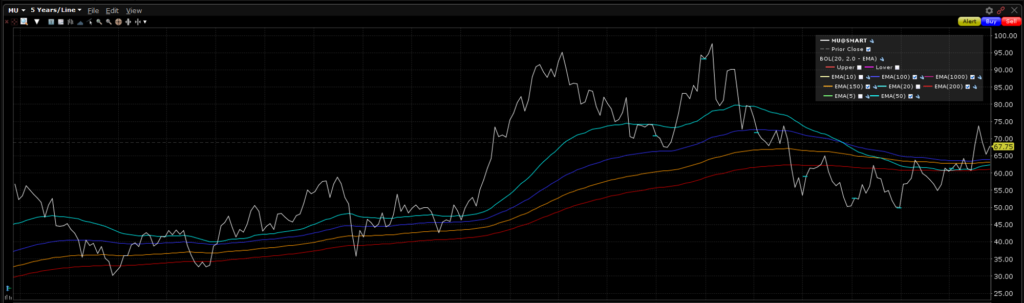

- Micron $MU interests me. I need to look into it more to know the degree of VRAM involvement. You can see from its margins why valuation multiples are justifiably lower. But remember we're making forward-looking calls here where value will accrue in an exponential growth curve.

- The most-critical semiconductor plays on the planet are $TSM and $ASML. The heartbeat of technology emanates for The Netherlands and Taiwan. Oil in the 70s, chips in the 2020s. Bet: US foreign policy will think they'll need more 'freedom' in the near future 😊 🇺🇸

- $AMAT and $LRCX are both semi equipment/packaging co's I’ve owned before that are reasonably valued and haven’t made major moves yet. I like.

- I’d like to own $INTC, especially as a western counterweight to $TSM. But Intel has well-known problems. If we’re looking at huge secular increases in demand and not in the rearview mirror it may be worth a small position. If the issues are well-known, it means they’re priced in

- $AMD is a Nvidia-style play that hasn’t made a $NVDA-style move. You can see from its margins why it doesn’t get a NVDA valuation. Also, they should probably lever themselves more heading into this secular gigaexplosion of compute. Look at how low its LT Debt/Equity is.

- Broadcom $AVGO caught my eye too. And, unlike AMD, look at that debt. But, look how competently they invest it. They have the highest revenue per employee and the highest gross margins and operating margin. Seems like a good business.

Stuff with low gross/operating margins don’t appeal to me. Per my previous comments and "commoditizing the complement" dynamics, it often means they don’t have sufficient leverage to set price, which means they probably don’t accrue much value. Higher margins are an indicator of someone who captures value in a supply chain. It’s the commodity-like products (fungible) that usually have their margins competed away; they’re not price setters, they’re price takers. This is an imperfect heuristic, but it feels right here.

As of now, I’m interested in and will likely add: ASML, TSM, AMD, LRCX, MU, INTC, NVDA, AMAT. I want to learn more about AVGO.

I’ll look into SK Hynix. Samsung is too much of a conglomerate for me to own as a semiconductor investment. I believe its semi business is about 30% of its revenue, so it’s not a pure play and I’m not keen on investing in electronics.

NFA, obviously. I’m just providing my framework for thinking here. Anyone with critique, feedback, or other suggestions please do feel free to share them.

Follow at @BackTheBunny

Check out another popular post --> Generations of War, Crypto, and Business: Part 3