The automated market maker (AMM) is a pioneering crypto primitive that has helped bring DeFi into existence. But we already had the orderbook, why did crypto need its own form of market making?

The answer to this is mostly pragmatics. Ethereum and crypto broadly are still scaling, and expensive transaction costs, low throughput, and slow settlement made the AMM the superior option given crypto’s technological constraints. Instead of computationally expensive orderbook market making, we can pool our tokens, provide constant liquidity, and allow trading without matching bids and asks while guaranteeing settlement.

There are of course drawbacks to the AMM model. You cannot submit limit or stop orders. You largely cannot chose at what price points you wish to provide liquidity. There is greater slippage to trades and LP’s have impermanent loss risk by having to provide equal amounts of both assets in a pool.

And there are AMM disadvantages that don’t show up in a quantitative way, but are a net negative to markets broadly. AMMs are what we can consider “informationally poor” liquidity sources. They largely derive their pricing via the well-known X * Y = K equation.

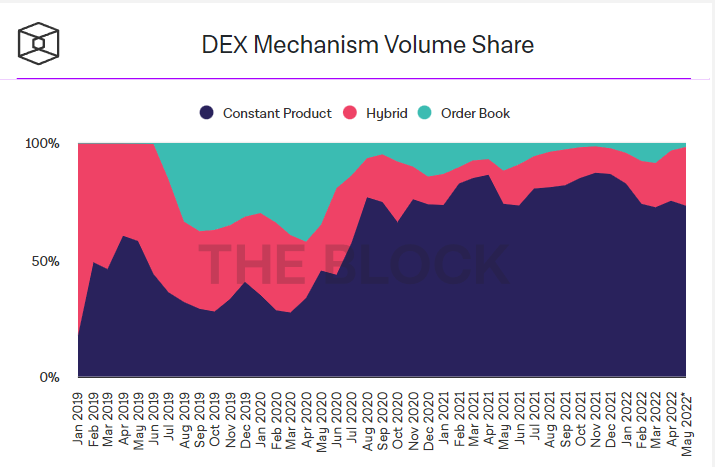

But information is a critical component to capital markets and asset pricing. In efficient markets, informed market makers (MM’s) should be the standard, and diversity of MM’s is important. Right now some 90% of DeFi trades are executed through AMMs. In a market with high-information orderbook MM’s, they can adjust prices automatically based upon bearish news, risk appetite, or even personal strategy. They don’t need an equation to tell them to modify their books.

In the AMM model, arbitrageurs are the actors that supply the information. But there’s a cost to this. When information must be embedded into price by arb’ing, it’s LP’s who bear that cost. Arbitrageurs scalp these profits and LPs cover this cost by way of impermanent loss.

In TradFi and its diverse set of MMs, we see many different ways to interpret information and strategies to make markets while turning a profit. These different methods (bull/bear, long/short vol, etc.) all compete against one another and other exchanges. This capitalistic cauldron creates the diversity of pricing and competition necessary to create the most efficient and liquid markets possible.

So while we love the AMM and it’s served us well as the core model for DeFi liquidity, it has many shortcomings, and DeFi would benefit from diversifying away from it. Its selection as the liquidity source of choice was out of necessity due to limited options, not because it’s the best model.

Enter Layer 2s on Ethereum

Layer 2s (and chains that facilitate high throughput and low costs) are the technological substrate needed to support the orderbook model. Just how Netflix was always the superior model to Blockbuster, but couldn’t exist until high-speed internet was the standard that could support video streaming, such is L2s for orderbooks in DeFi.

With orderbooks we can match buyers and sellers with tight spreads. We can incentivize deep liquidity, limit/stop orders, and more sophisticated, high-information markets. DeFi now has the infrastructure in place to graduate to the next model of liquidity provision. RabbitX utilizes an orderbook model, with ZK rollups on Ethereum.

We aim to bring much informational diversity and liquidity to the DeFi space, and hope to have you along for the ride.

Follow at @BackTheBunny