Context on the market crash, here's what we see:

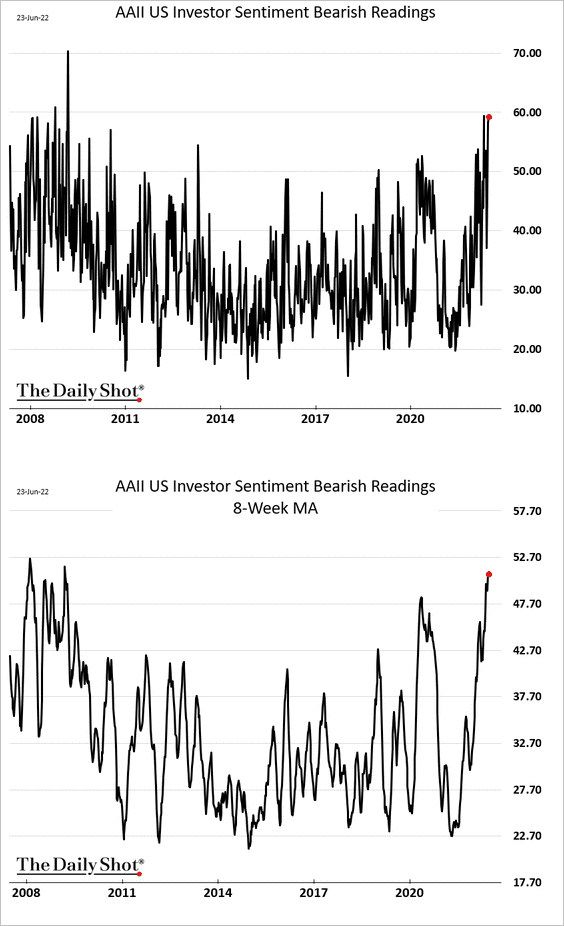

- US investor sentiment is hyper bearish

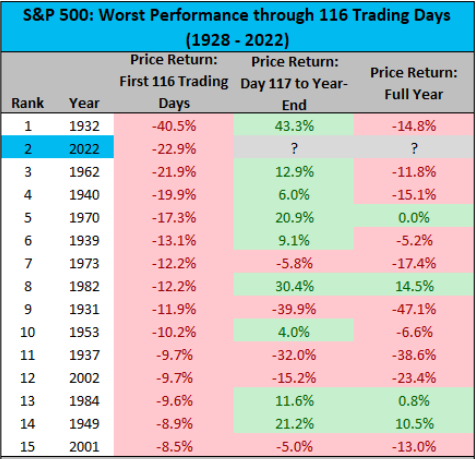

- We are in the midst of a historically bad market to start the year (and what typically happens next)

- FTX wants to buy everything

- About half of crypto traders have quit

- The market wipeout, in context

Percentage of US investors who are bearish is now the highest since the financial crisis. Goodness.

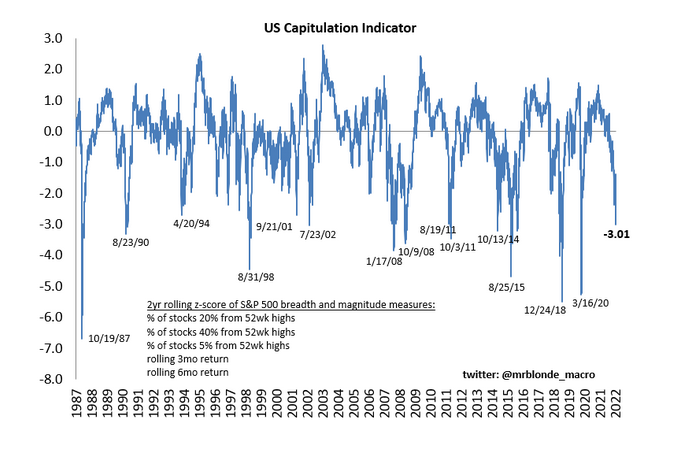

However by some measures, true capitulation still hasn’t quite happened yet.

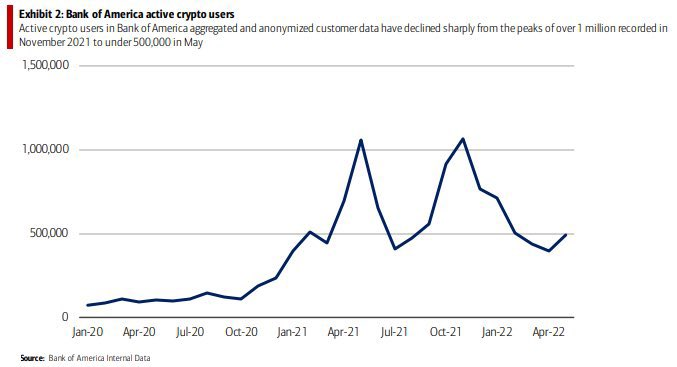

In something of a bullish contra indicator, we have seen a massive reduction in the total amount of crypto traders. Active trader count is down by 50% according to BAML. We hate to see it, but this is a natural part of deleveraging cycles.

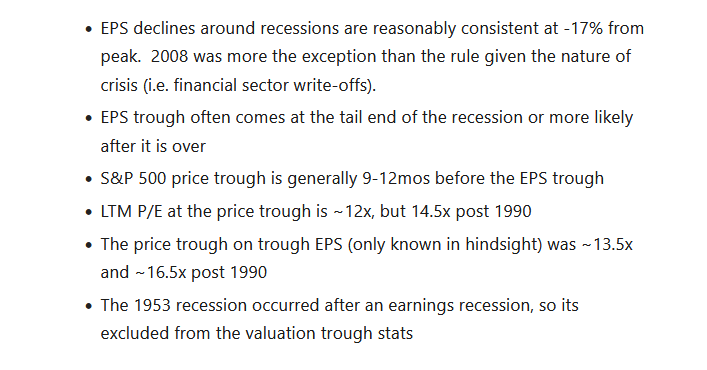

We likely are headed for a bad recession, so take a note of that S&P leading price action. The market tends to bottom a whopping 9-12 months before earnings do! This speaks to why markets often go up while economic data would have you think otherwise: they typically already priced in that data and are now looking forward another 6-9 months (for equities markets anyways).

2022 has been historically awful. Take a look at what the year-end returns typically are after starts this bad in the stock market.

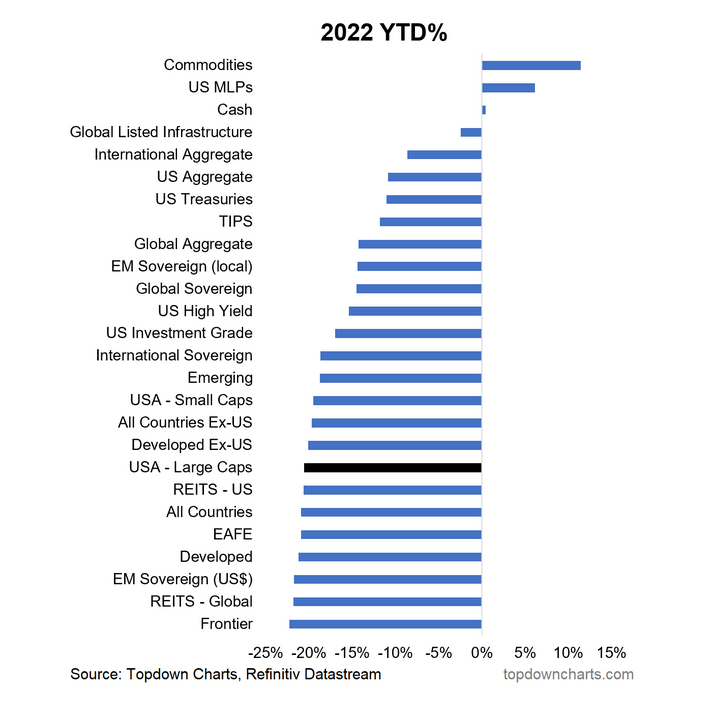

YTD Returns by asset class: H1 2022 was not just bad for stocks and crypto. Basically nothing besides cash and commodities has worked. We’re all in this together 🤝.

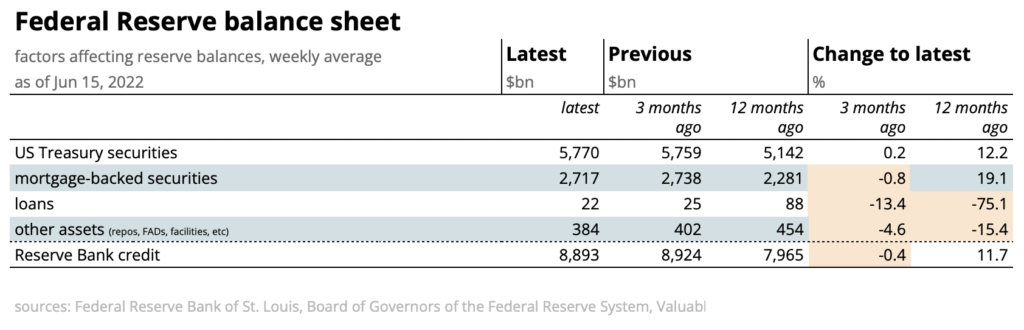

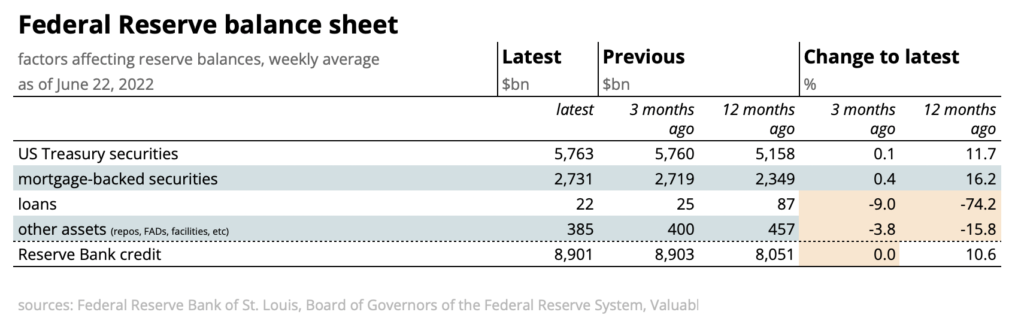

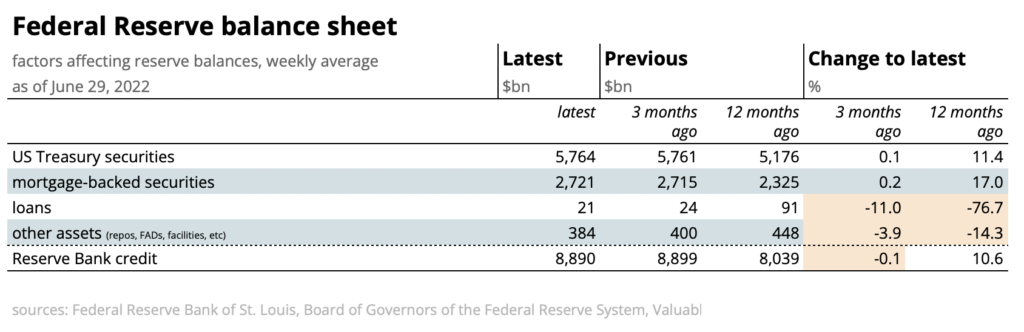

An update on Fed quantitative tightening

June 15th-22nd, the Fed trimmed $7.3bn net from its Treasury security holdings and added $14bn net to its mortgage-backed security holdings. The total amount of Reserve Bank credit increased by $8bn net.

Then from June 22nd-29th it increased its UST holdings by $1B and decreased MBS by $10B and other assets by $1B. For a net decline of $11B.

However since June 15th, this nets out to only a decline of $3B in net assets on the Fed’s balance sheet.

Some crypto updates

Harmony bridge hacked badly. $100M stolen. Extremely sad to see. We wish the chain and all builders on Harmony the very best during this trying time. Here are more details from Harmony.

FTX wants to own…. everything

Sam very much intends to get into the stock game:

FTX Unit Buys Stock-Clearing Platform Embed to Expand Equity Trading Infrastructure

FTX Is Seeking a Path to Buy Robinhood

FTX is also is actively hunting around the CEX-lender wreckage:

FTX US deal with troubled crypto lender BlockFi floats acquisition with ‘up to’ $240M purchase price

FTX Passed on Deal to Purchase Celsius Due to Deficient Balance Sheet

And some context on it all

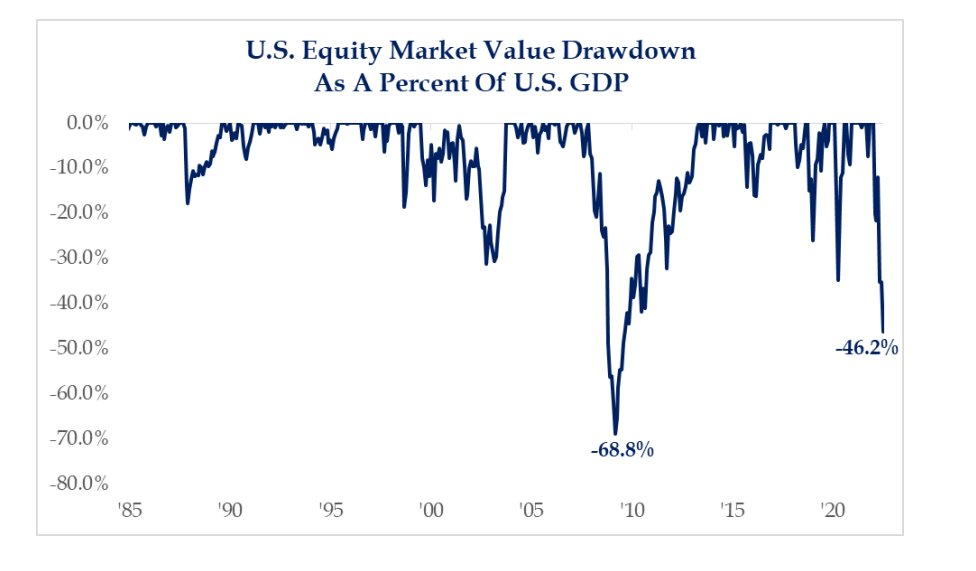

The equity wipeout has been incredible by some metrics. 46% of US GDP worth of market cap eliminated in about 6 months.

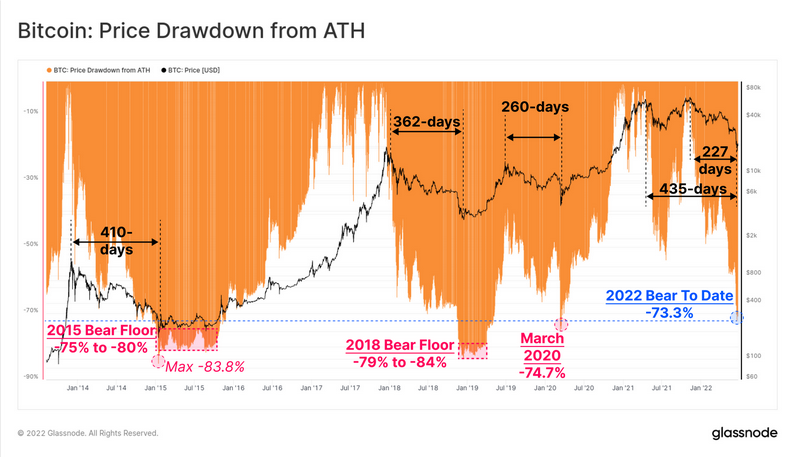

Bitcoin is approaching drawdown territory that is within reach of the 2018 crash. So bad, it may be a tad good…?

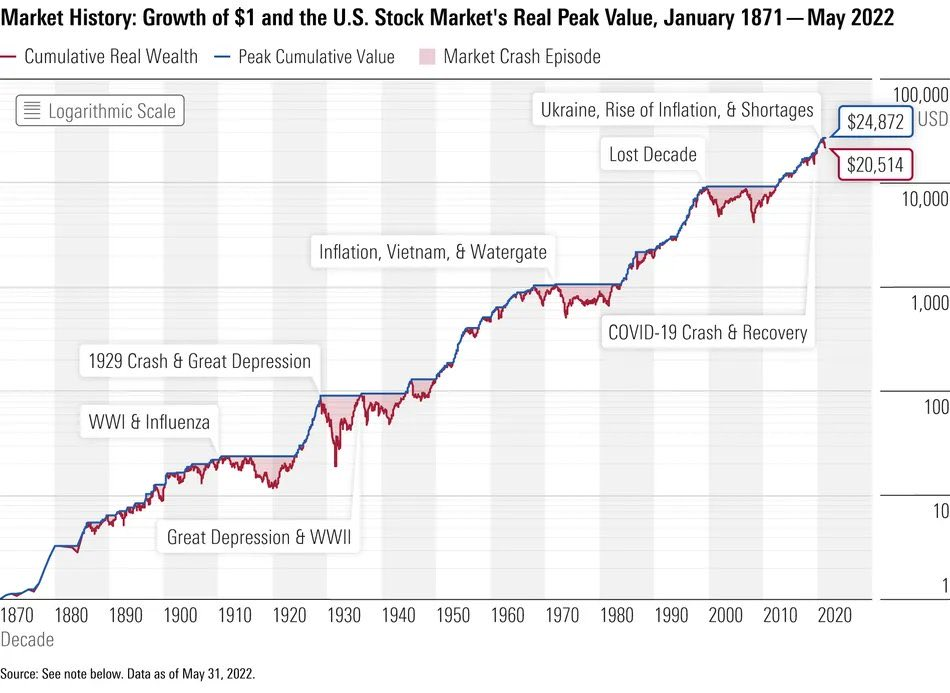

However, some context is always helpful.

Look at what we’re fretting about, and look at what we’ve overcome in the past.

In hindsight, it’s easy to see. When experiencing in real time, it feels like the world is ending. Just keep building.